Introduction

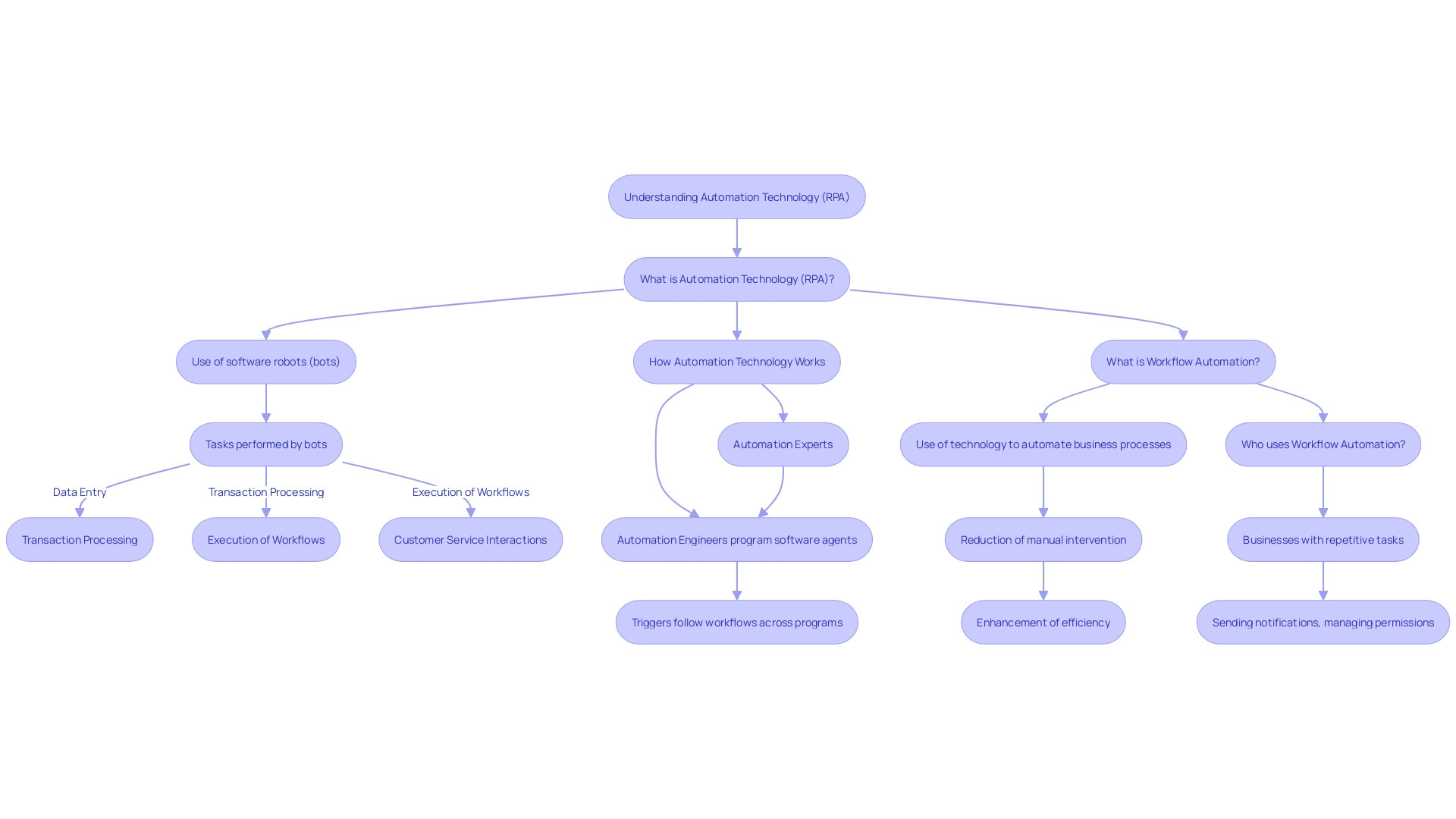

The integration of automation and artificial intelligence into the banking sector is revolutionizing how financial institutions operate. With advanced software and robotic process automation (RPA), banks can enhance precision, elevate operational efficiency, and allocate human resources to more complex roles. The transformative power of RPA lies in its ability to accurately execute tasks across multiple systems, from data handling to customer service operations.

This article explores the benefits, key areas, implementation strategies, case studies, challenges, and future trends of banking automation. It highlights the industry’s drive towards digital innovation and the potential for AI and machine learning to streamline finance functions. Stay tuned to discover how automation is reshaping the banking workforce and enhancing the customer banking experience.

What is Banking Automation?

The incorporation of mechanization and artificial intelligence into the banking sector is transforming how financial institutions operate. Cutting-edge software and robotic process RPA are assuming control of routine and labor-intensive tasks, empowering banks to improve accuracy, enhance their operational efficiency, and allocate human resources to more complex and strategic roles. The transformative power of RPA lies in its ability to accurately execute tasks across multiple systems, from data handling to transaction processing and customer service operations.

Industry leaders like M&T Bank, with its long 165-year history, are leading the way in establishing high-quality standards for software development to ensure that their tools for streamlining processes are not only effective but also secure and compliant with strict regulations. Similarly, Capital One’s bold move to fully migrate to the cloud and utilize Slack across various departments exemplifies the sector’s drive towards fostering a collaborative environment conducive to digital innovation.

The need to embrace these technologies is further emphasized by the reality that around 80% of operations in the finance sector are ready for streamlining, indicating a significant opportunity for the implementation of AI and machine learning in enhancing finance functions. By implementing these technologies, banks can significantly redirect employee efforts towards initiatives that enhance customer satisfaction and strategic growth.

As the financial landscape increasingly intertwines with Big Tech, institutions must stay abreast of the latest advancements in automation to remain competitive. With AI and generative AI poised to impact 73% of financial roles, according to Accenture, the potential for operational transformation is immense, promising substantial productivity gains for early adopters and a reshaping of the financial workforce. This transformation is not only about decreasing the time spent on tasks but also about enhancing the customer experience and maintaining the human touch in digital interactions.

Benefits of Automation in Banking

Banks are rapidly embracing automation to stay competitive in the digital era, with AI and automation tools at the forefront of this transformation. For example, M&T Bank’s dedication to Clean Code standards is evidence of the industry’s emphasis on high-quality, efficient software to support financial operations. This focus on particulars in software development allows banks to offer enhanced services to individuals with greater efficiency and security.

Furthermore, the incorporation of AI in banking is transforming service to clients. One Zero Bank’s introduction of the GenAI-powered platform ‘Ella’ 2.0 demonstrates this pattern, providing individuals with real-time, tailored financial services. This AI-driven approach is not only enhancing the customer experience but also significantly boosting operational efficiency. In fact, generative AI has the potential to reduce working hours in the financial sector by 72%, pointing to a substantial leap in productivity for early adopters.

The mechanization of regular financial tasks through AI and other technologies permits resource optimization and a decrease in the need for human intervention, which ultimately results in cost savings. This is observed in the wider trend of increased implementation of industrial robots and AI applications across various industries, with a projected market value of $265 billion by 2025.

In conclusion, the industry’s adoption of automation and AI technologies is generating a environment where operational effectiveness, client contentment, and cost-efficiency are being greatly improved, demonstrating a revolutionary change in the manner financial services are provided and encountered.

Key Areas for Automation in Banking

Automation, specifically Robotic Process Automation (RPA), is revolutionizing the banking industry by emulating and executing actions across various systems, often previously performed by humans. Significantly, onboarding and KYC processes, loan origination, payment processing, fraud detection, compliance, and service to clients are areas ripe for RPA implementation. For example, the implementation of a generative AI-driven chatbot by ING showcases the potential of technology in improving interactions with clients, with a substantial number of inquiries resolved without the need for human involvement. Meanwhile, Capital One’s complete transition to the cloud and utilization of Slack for collaborative work exemplify the transformative impacts of RPA throughout an organization’s operations.

The launch of ‘Ella’ 2.0 by One Zero Bank, a GenAI-based digital private banker, signifies a milestone in AI integration within financial services, offering personalized guidance and real-time, 24/7 customer assistance. This aligns with the World Economic Forum’s findings that AI will significantly impact jobs in IT, Finance, and Customer Sales. Furthermore, according to Accenture’s analysis, 73% of US bank employees’ time could be affected by generative AI, with 39% of tasks potentially automated.

The financial sector is experiencing a surge of technology advancement, as demonstrated by the 3.5 million industrial robots in manufacturing, valued at $15.7 billion. With the ability to perform tasks across various platforms, technology is becoming the foundation of efficient operations, indicating a significant change in daily technological interactions and economic implications.

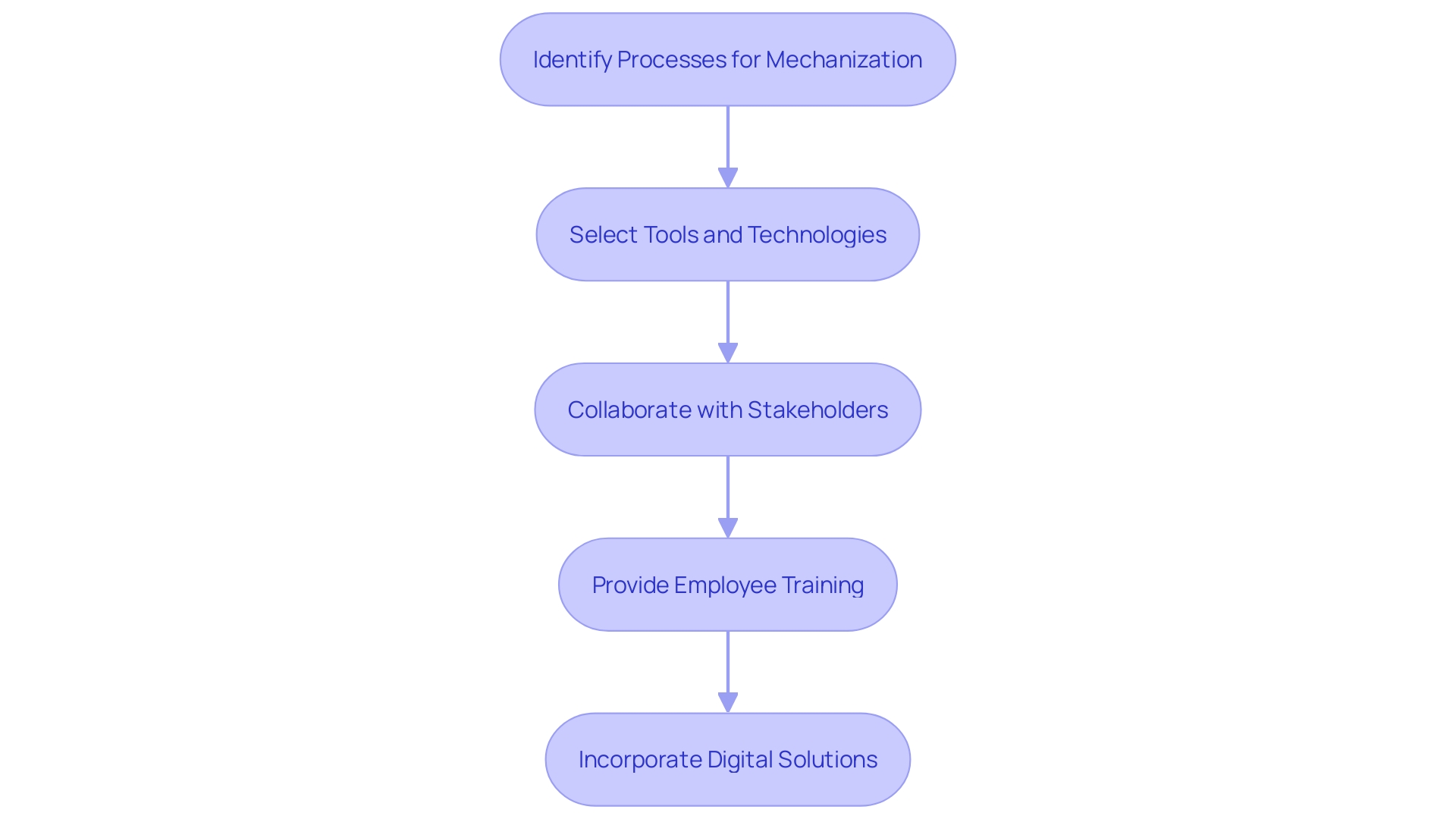

How to Implement Banking Automation

Beginning the process of banking digitization is a strategic undertaking that necessitates careful planning and skilled implementation. Financial institutions must initially identify which processes are ready for mechanization and assess the possible benefits. Selecting the appropriate tools and technologies is vital, with a range of choices available such as Robotic Process Automation (RPA) platforms and AI-enhanced solutions.

Essential for the success of an initiative is the collaboration of all relevant stakeholders. IT, operations, and compliance teams must be integral to the implementation process. Furthermore, equipping employees with comprehensive training is vital for a seamless shift to automated operations.

Illustrating the significance of such measures, M&T Bank has taken strides to set organization-wide Clean Code standards to enhance the maintainability and performance of its software, reflecting the industry’s push towards digital transformation and the need for stringent security and regulatory compliance.

Meanwhile, Capital One has harnessed the power of Slack to foster a culture of innovation, automating workflows and fostering collaboration among its 50,000-strong workforce. This culture of digital-forward thinking was acknowledged when Capital One received the Innovation in Slack Award for utilizing the platform to enhance user experiences.

Aligned with the swift digitization of the banking industry, OCBC is implementing a ChatGPT-driven system to all 30,000 staff members, while NetSuite is integrating AI to streamline tasks such as composing collection letters, showcasing the sector’s shift towards AI and streamlining to improve effectiveness and client support.

With experts like Shagun, a former Fortune 100 auditor, emphasizing the reality that an impressive 80% of financial operations can be mechanized to release employee time for strategic initiatives, it’s evident that AI and ML can transform finance mechanization. As Omar Hatamleh, an AI expert, underscores, proactivity and diversity are essential for the future of AI, emphasizing the need for a forward-thinking approach to adopting these technologies.

With the growing significance of environmental, social, and governance (ESG) considerations, customers are demanding financial solutions that align with their values, compelling banks to incorporate ESG principles into their operations, further reinforcing the need for innovative digital solutions in the financial industry.

Case Studies in Banking Automation

The financial sector is undergoing a seismic shift towards digitalization, and leading institutions are utilizing automation and AI to transform their operations. M&T Bank, with its storied history, has set a benchmark by establishing Clean Code standards to ensure the quality and compliance of its software, essential in the digital financial realm. Capital One’s progressive move to the cloud, using Slack to foster a culture of transformation and collaboration, exemplifies its commitment to innovation. The bank’s recognition for its inventive use of Slack underscores its role as a digital leader.

Advancements in the financial sector are not restricted to operational enhancements; they also expand to user involvement. One Zero Bank’s introduction of ‘Ella’ 2.0, a GenAI-based digital private banker, marks a significant milestone. This AI-powered platform offers immediate, multilingual assistance, functioning 24/7 and providing tailored financial services. With its launch, One Zero Bank exemplifies the future of banking, where customer service is seamless, swift, and secure.

These developments are indicative of a broader trend. According to Accenture, 73% of US bank employees’ time could be affected by generative AI, through both mechanization and augmentation. Early adopters of such technology could see a substantial productivity improvement over the next three years. The Total Economic Impact study further highlights the financial benefits of intelligent technology, with a reported 73% of overall net present value (NPV) benefit and a 5.4% compound annual growth rate (CAGR) stemming from such investments.

TBC Bank in Georgia is also embracing this trend, aiming to enhance its digital product delivery speed and user experience. These instances clearly showcase the transformative power of AI and mechanization in the financial sector, enhancing effectiveness, client contentment, and ultimately, the financial outcome.

Challenges and Limitations of Banking Automation

Advancements in artificial intelligence (AI) and automation have propelled the banking industry into a new era of digital transformation. While these technologies offer unparalleled opportunities for efficiency and client service, they also introduce new challenges that banks must navigate diligently. Protecting customer data is paramount, as automated systems handle a vast amount of sensitive information. To this end, financial institutions like M&T Bank, with its extensive history and reputation, are establishing rigorous ‘Clean Code’ standards to ensure their software meets the highest quality and compliance benchmarks, thus safeguarding operations and client trust.

Integrating automation with existing legacy systems presents its intricacies. It requires strategic planning and a commitment to continuous improvement. Capital One, a pioneer in banking innovation, exemplifies this by leveraging collaborative platforms like Slack to automate workflows and foster a culture ready to embrace digital transformation.

Furthermore, preserving the human connection in client relationships remains crucial. Uri Rivner, CEO of Refine Intelligence, highlights that traditional one-on-one interactions provided valuable insights into consumer behavior, something that banks must strive to preserve even as they harness Ai’s power. As banks like Barclays UK explore conversational AI, they strive to find a harmony between mechanization and human judgment, ensuring customer service does not become impersonal.

Lastly, AI and automation can inadvertently lead to workforce apprehension due to potential job displacement. It’s imperative for banks to articulate the benefits of these technologies, such as the creation of new roles and the elimination of tedious tasks, to foster employee acceptance and engagement.

In summary, the journey towards a fully automated banking system is laden with challenges, but with careful planning, adherence to stringent security protocols, and a commitment to maintaining human elements within digital relationships, banks can navigate this transition successfully. As Omar Hatamleh, AI Expert and Former Chief Innovation Officer at NASA, suggests, a proactive and diverse approach to Ai’s future will be crucial for the industry. With the right strategies, financial institutions can leverage Ai’s potential while ensuring ethical considerations and client relations remain at the forefront of their operations.

Future Trends in Banking Automation

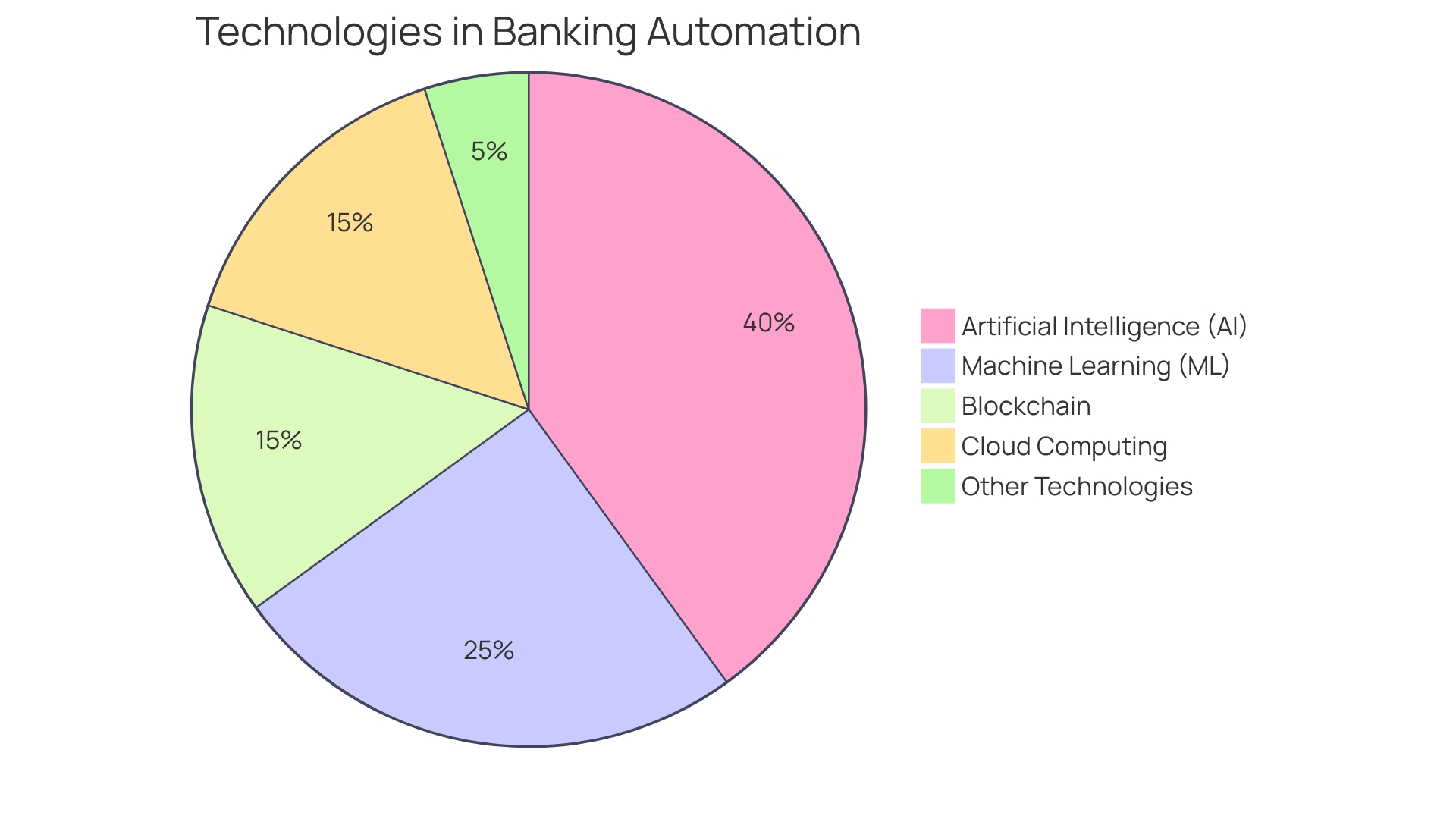

Banking automation is rapidly advancing, driven by the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advancements are not only enhancing customer service through intelligent chatbots and predictive analytics but also revolutionizing security and transparency with blockchain. The seamless integration of these tools across digital channels facilitates unparalleled access to financial services. Pioneers like M&T Bank, with their emphasis on Clean Code standards, demonstrate the industry’s dedication to upholding the integrity and performance of software for the financial sector, a crucial element of services that heavily depend on data security and regulatory adherence.

With the digital banking landscape transforming, institutions like Capital One are pioneering the journey, having transitioned entirely to cloud computing. The utilization of collaborative platforms such as Slack underlines the importance of fostering a culture conducive to innovation and digital transformation. Such technologies not only streamline operations but also empower employees across all departments to contribute to the bank’s evolution. The concept of Regtech, which includes AI, blockchain, and cloud computing for compliance tasks, is gaining traction and is expected to become increasingly significant by 2024, especially with the growing complexity of regulatory requirements concerning personal data and privacy.

While the sector deals with Big Tech’s entry into banking services, traditional banks are using technology to remain competitive. Advancements in FinTech are prompting institutions to remain agile and informed. The incorporation of AI into business operations, as demonstrated by its widespread implementation in marketing, sales, and product development, demonstrates the revolutionary effect of AI on the financial industry. From the start of Python for Data Analysis to the acceptance of software libraries like pandas, SKLearn, and TensorFlow, the financial sector has embraced machine learning to enhance financial analysis and customer engagement. The promise of AI in banking is clear, as it continues to be a vital component of industry innovation, ensuring a future that is not only more efficient and customer-centric but also ethical and inclusive.

Conclusion

In conclusion, automation and AI are revolutionizing the banking sector by enhancing operational efficiency and customer satisfaction. RPA accurately executes tasks across systems, allowing banks to allocate resources effectively and improve precision.

Automation brings significant benefits, enabling banks to provide improved services efficiently and securely. AI-driven platforms like One Zero Bank’s ‘Ella’ 2.0 offer real-time personalized financial services, boosting efficiency. It also leads to cost savings and resource optimization, seen in the surge of industrial robots and AI applications.

Key areas for automation in banking include customer onboarding, loan origination, payment processing, fraud detection, compliance, and customer service. Implementing automation requires strategic planning, collaboration, and comprehensive training. Banks like M&T Bank and Capital One have successfully implemented automation with standards and a culture of innovation.

While challenges exist, such as protecting customer data and integrating with legacy systems, careful planning and adherence to security protocols can overcome them. Maintaining the human touch in customer relationships is crucial. Banks can transition to a fully automated system by taking a proactive approach to AI’s future.

The future of banking automation is promising, driven by AI and machine learning. Advancements in chatbots, predictive analytics, and blockchain revolutionize customer service, security, and transparency. The industry’s commitment to software integrity ensures an efficient, customer-centric, and ethical future.

In summary, banking automation improves operational efficiency and customer satisfaction. Banks can streamline operations, stay competitive, and deliver innovative solutions by embracing automation and AI. Despite challenges, banks can successfully navigate the transition and shape a future empowered by technology.

Experience the power of automation and AI in banking today!