Introduction

The banking industry is undergoing a transformative journey, driven by the adoption of automation and artificial intelligence (AI). These advancements are not merely enhancing cost efficiency but are revolutionizing the entire operational framework of financial institutions. From significantly reducing transaction times to minimizing human errors, automation is paving the way for a more reliable and customer-centric banking experience.

Case studies, like that of Arab National Bank, demonstrate the remarkable efficiency gains achievable through digital transformation. Robotic Process Automation (RPA) is streamlining compliance processes, reducing penalties, and fostering a robust regulatory reputation. The integration of AI in fraud detection and risk management further underscores the critical role of these technologies in safeguarding the financial ecosystem.

As the industry looks ahead, the future trends in banking automation, including predictive analytics and sophisticated chatbots, promise to deliver personalized customer experiences and accelerated operational capabilities. By embracing these innovations, banks are not just keeping pace with technology but are setting new standards for efficiency, security, and customer satisfaction.

Benefits of Automation in Banking

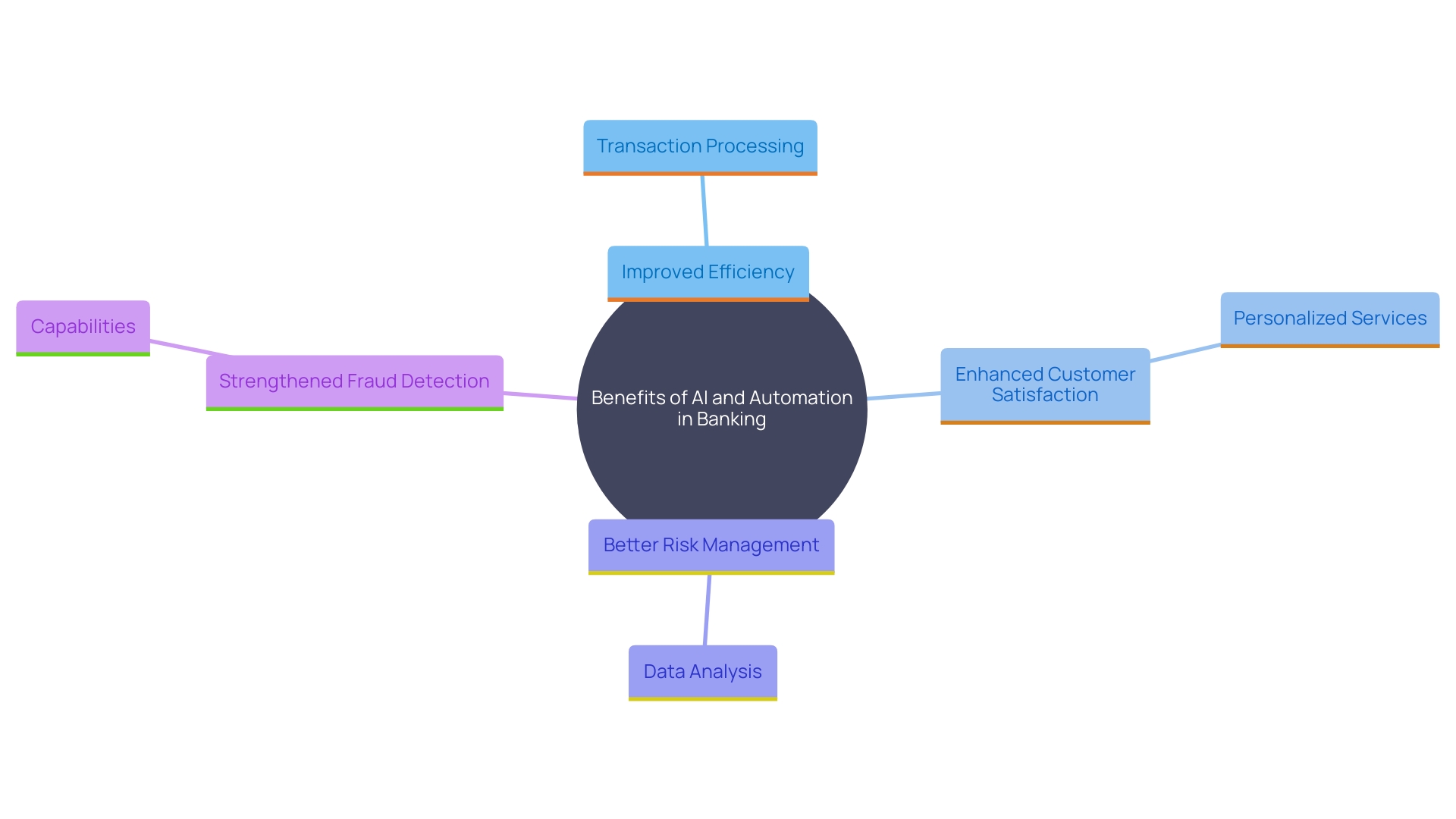

The banking sector has undergone a significant change with the incorporation of AI and automated technologies, signaling a new period of productivity and improved service delivery. Beyond mere cost savings, mechanization offers significant advantages such as improved efficiency, where automated processes drastically cut down the time required for transactions and client services. This is further evidenced by SeatGeek’s experience, where AI-powered technology reduced expense management from 20 hours a week to just one hour.

Furthermore, mechanization reduces human mistakes, guaranteeing a more dependable and flawless service. Customer satisfaction has also seen a notable improvement as automation facilitates quicker responses and personalized services tailored precisely to client needs. Banks can now allocate their resources more strategically, focusing on innovation and strategic initiatives rather than mundane and routine tasks.

In the realm of risk management, AI plays a pivotal role by analyzing consumer behavior, market trends, and economic indicators, which helps financial institutions anticipate and manage potential risks more effectively. ‘This technological integration not only enhances operational efficiency but also fortifies the overall security and reliability of financial services.’.

The adoption of AI in fraud detection is particularly noteworthy. AI systems can swiftly process vast amounts of transactions, identifying and mitigating fraudulent activities with remarkable precision. This capability significantly bolsters the security framework within which banks operate, instilling greater trust and reliability in their services.

In essence, the infusion of AI and mechanization in the financial sector is not just about keeping pace with technological advancements; it’s about leveraging these innovations to create a smarter, more efficient, and customer-centric financial environment.

Case Study: Digital Transformation in Finance

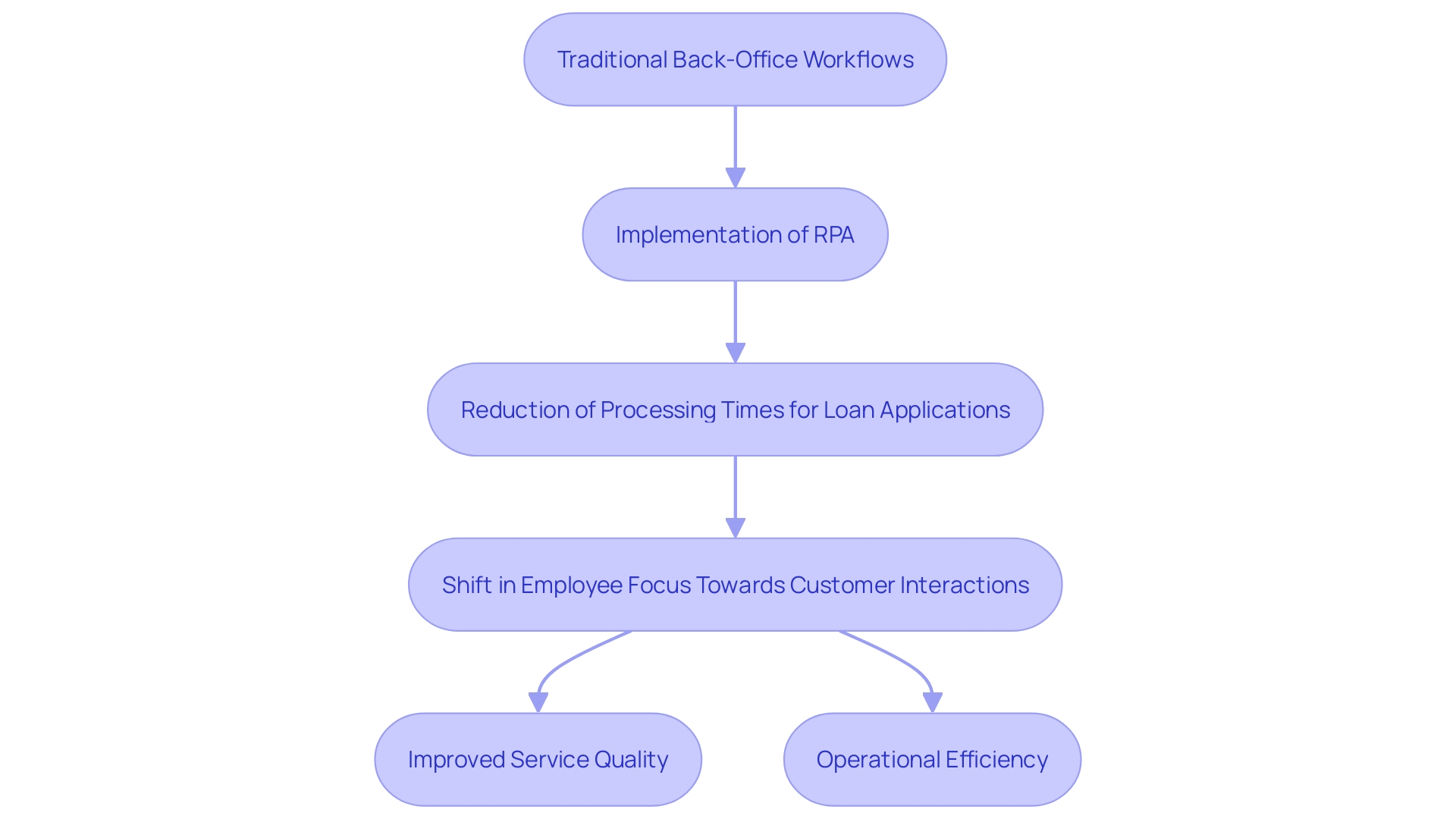

Arab National Bank (anb), one of Saudi Arabia’s oldest financial institutions, embarked on an ambitious digital transformation journey to stay ahead in the rapidly evolving banking landscape. By utilizing robotic process systems (RPA) and advanced AI technologies, and reengineered its back-office workflows, significantly enhancing operational efficiency.

The implementation of RPA allowed automated bots to take over repetitive tasks such as data entry and verification, tasks traditionally performed by human employees. This shift resulted in a remarkable 60% reduction in processing times for loan applications, mirroring the success seen by a leading European bank. Moreover, the system reduced processing errors and allowed staff to concentrate on more valuable customer interactions, thus enhancing overall service quality.

This transformation was driven by the need to move away from legacy tools and platforms that had created operational silos and regulatory risks. By embracing modern digital technologies, and not only optimized its operations but also set a new standard for innovation and customer service in the financial sector.

RPA Innovations in Banking

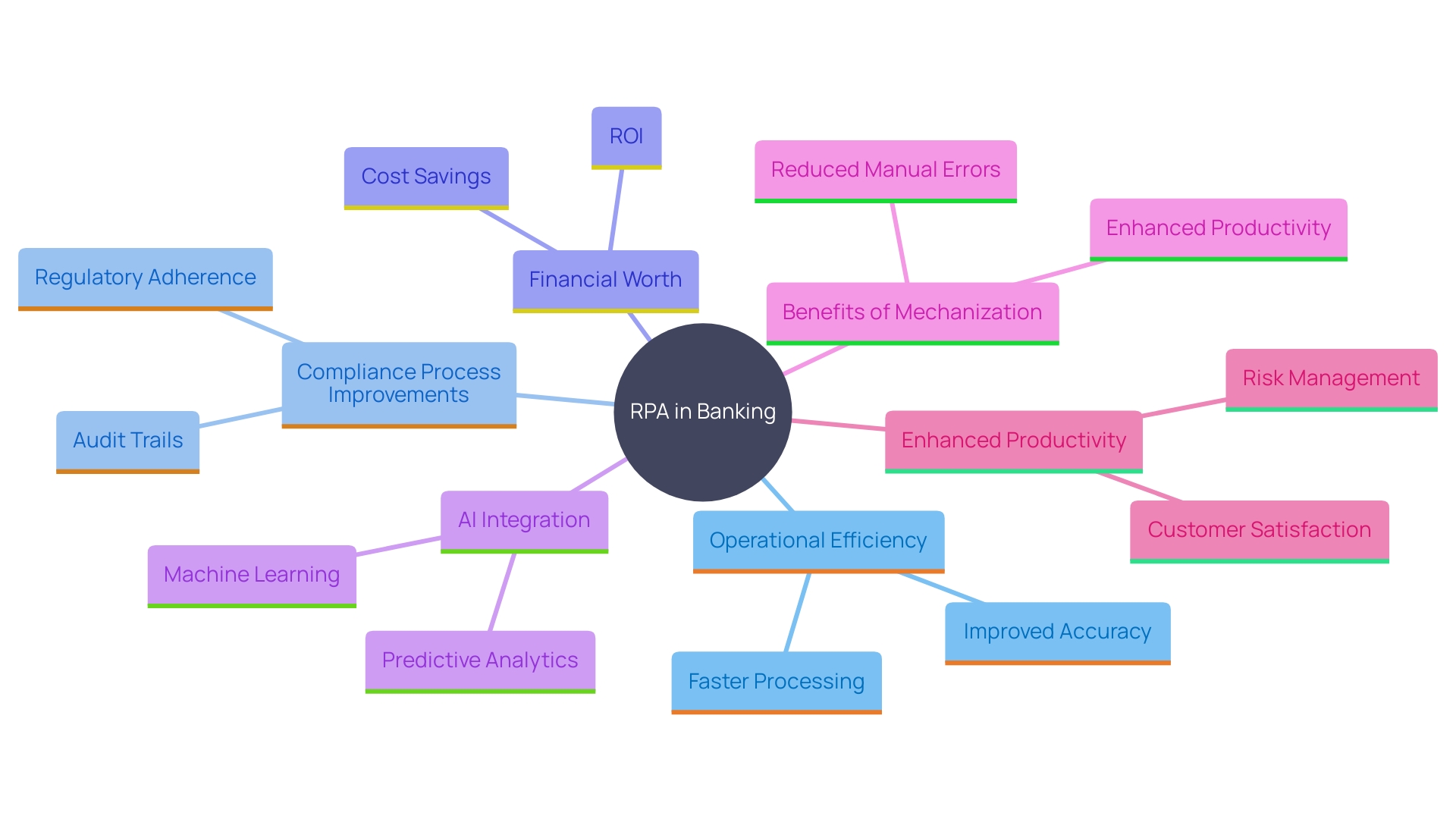

Robotic Process Automation (RPA) has revolutionized operational efficiency in the banking sector. By adopting RPA, a prominent financial institution was able to streamline its compliance processes significantly. ‘The mechanization of data collection and reporting for regulatory compliance not only ensured precision but also drastically reduced the time previously spent on manual tasks.’. This enhancement led to a notable decrease in compliance-related penalties and bolstered the bank’s reputation among regulators.

To put this into perspective, automated processes can be likened to the strategic craftsmanship of creating a suit that enhances efficiency and aligns with core operational needs. ‘The potential financial worth obtained from such mechanization is considerable, especially when comparing the time needed for manual completion of tasks versus automated processes.’. This approach provides a holistic view of operational maturity and readiness, enabling institutions to identify areas for improvement and trends over time.

Moreover, by utilizing technologies such as AI-driven systems, banks can confront the primary difficulties of implementing and incorporating new solutions with their current data framework, while also addressing data security and privacy issues. For instance, Temenos Generative AI solutions have demonstrated how transparency and explainability in AI can enable users and regulators to validate results, thereby changing effectiveness in banking operations.

In today’s ever-changing business environment, mechanization is not merely an instrument but an essential element that provides enhanced productivity by removing manual and repetitive duties. As stakeholders navigate through complex regulatory requirements and market dynamics, targeted automation proves to be a safeguard, reducing risks and maximizing operational integrity.

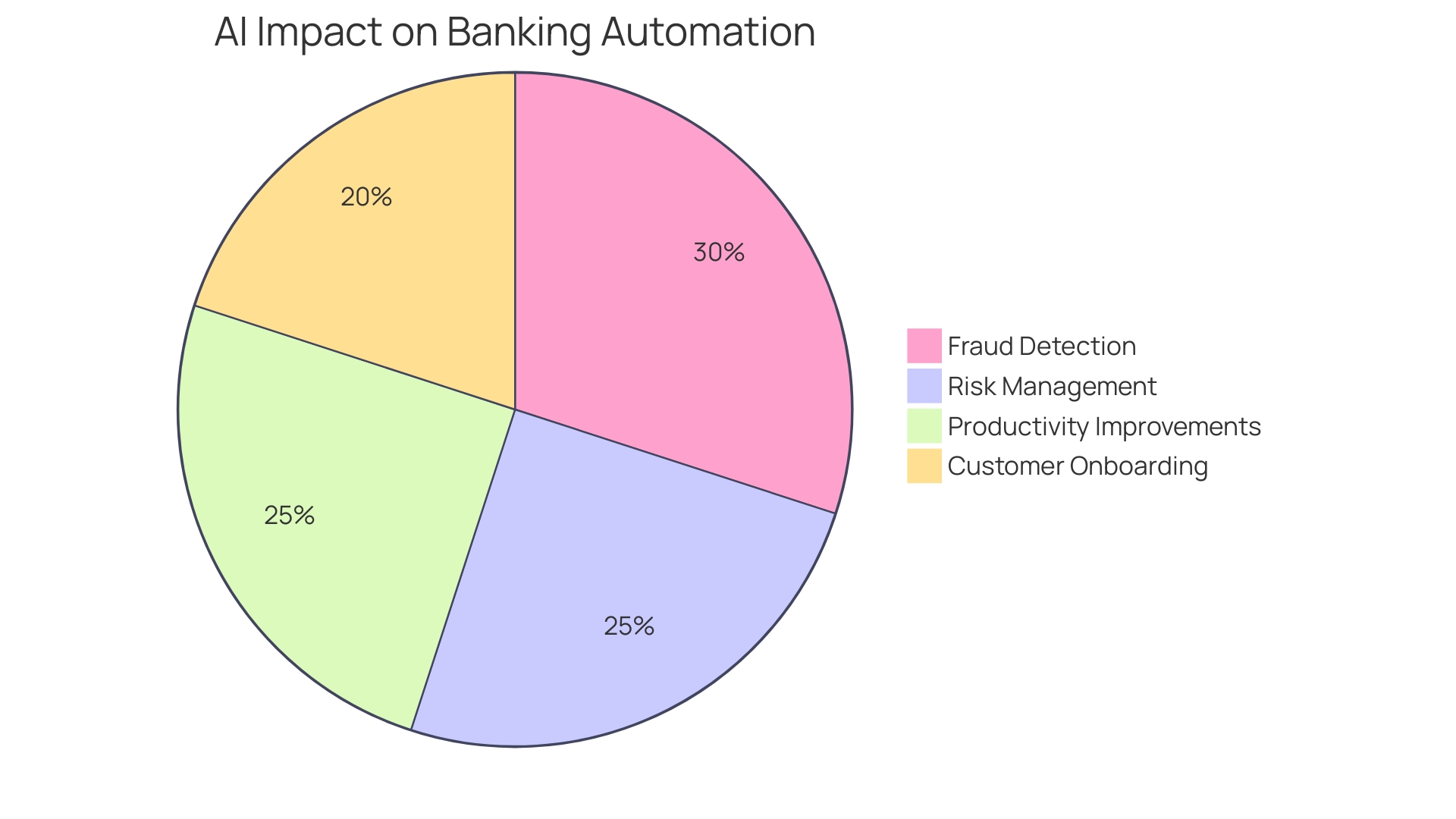

Use Cases of Automation in Banking

Automation in banking has revolutionized various processes, driving efficiency and improving customer experience. A standout example is the transformation of customer onboarding through automated identity verification systems. Leveraging machine learning algorithms, these systems swiftly analyze documents and verify client identities, streamlining the onboarding experience. In the realm of fraud detection, AI-driven systems oversee transactions in real-time to identify and flag suspicious activities, enabling financial institutions to respond proactively to potential threats.

Moreover, AI has significantly enhanced risk management by examining consumer behavior, market trends, and economic indicators, enabling banks to anticipate and mitigate risks effectively. The McKinsey report highlights the profound impact of AI in financial services, projecting a potential increase in productivity of 2.8% to 4.7% of the industry’s annual revenues, equivalent to an additional $200 billion to $340 billion. This transformation is not just limited to operational efficiency but extends to customer satisfaction and decision-making, ultimately safeguarding the financial ecosystem against fraud and other risks.

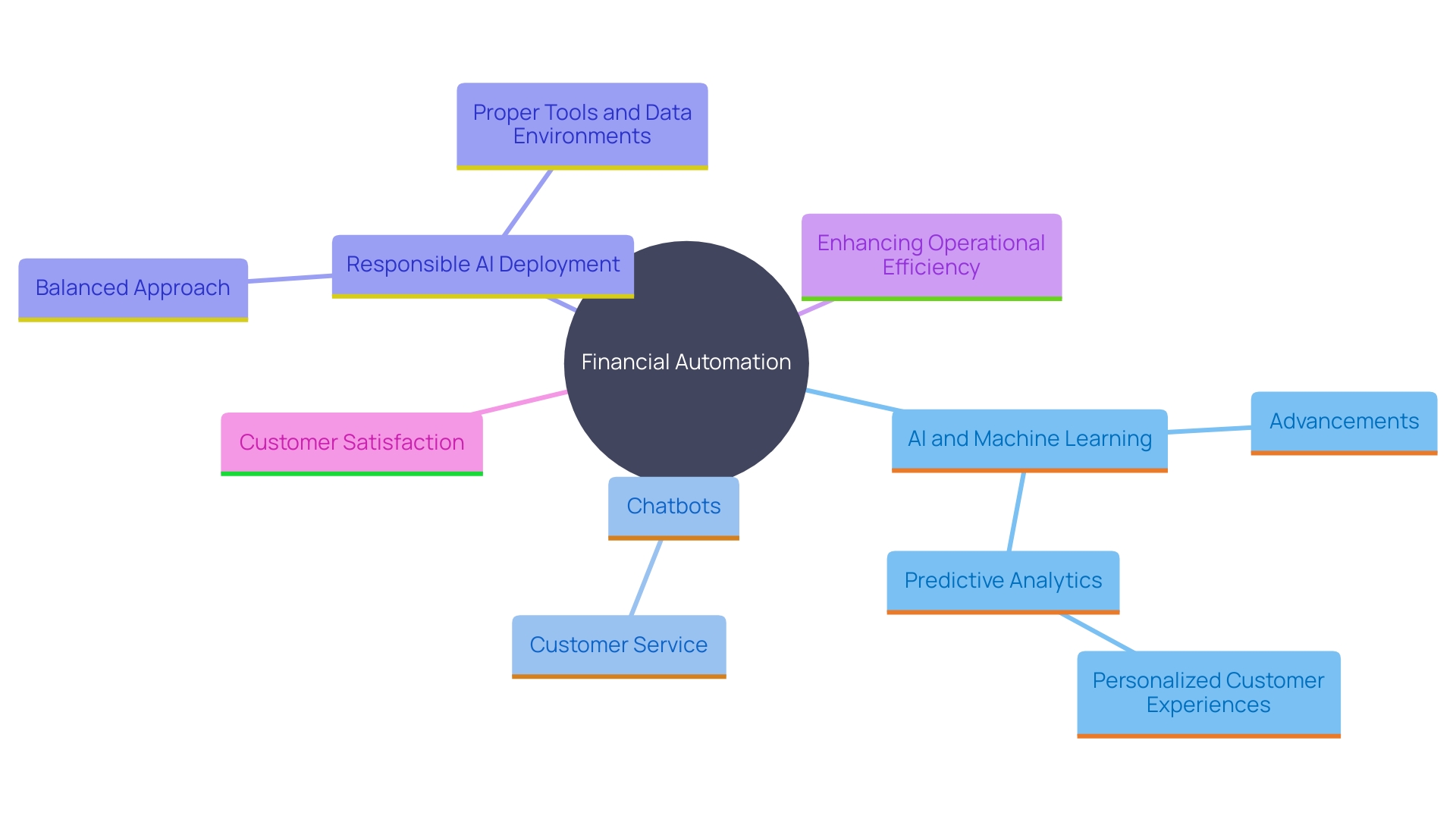

Future Trends in Banking Automation

The future of financial automation is set to revolutionize the industry through advancements in AI and machine learning. Predictive analytics will play a crucial role in personalizing customer experiences by allowing banks to anticipate needs and offer tailored solutions. This evolution is supported by Ai’s ability to analyze vast amounts of data to provide real-time financial advice and product recommendations precisely when customers need them.

Moreover, the integration of sophisticated chatbots for customer service will enable seamless and efficient interactions, significantly improving customer satisfaction. This technological shift is already evident, as AI systems have enhanced financial risk management by examining consumer behavior, market trends, and economic indicators to anticipate and manage risks effectively.

‘A notable case highlights how a financial group created a common data model and an analytical abstraction layer, enabling rapid deployment of use cases across multiple countries.’. This innovation shortened the timeline for implementing new analytics solutions from five months to six weeks, demonstrating AI’s potential to speed up financial operations.

Responsible AI deployment is essential to ensure fair, unbiased, and explainable models that stakeholders can easily understand and trust. As financial institutions continue to invest in these technologies, their focus will shift towards creating a more agile and responsive financial environment. This evolution promises enhanced operational efficiency and a superior customer experience, ultimately positioning banks to thrive in an increasingly digital world.

Conclusion

The integration of automation and AI within the banking sector is not merely a trend but a transformative movement reshaping the industry. Key benefits include enhanced operational efficiency, improved customer satisfaction, and a fortified security framework. By streamlining processes, banks can significantly reduce transaction times and human errors, leading to a more reliable service.

The case study of Arab National Bank exemplifies how digital transformation can optimize operations and elevate customer interactions, setting new benchmarks for the industry.

Robotic Process Automation (RPA) has emerged as a game-changer, particularly in compliance and risk management. Its ability to automate repetitive tasks not only minimizes processing times but also enhances accuracy, thereby reducing compliance-related penalties. As banks embrace these innovations, they are not just adapting to change but actively driving it, ensuring that they remain competitive in a rapidly evolving landscape.

Looking ahead, the future of banking automation promises further advancements with predictive analytics and sophisticated AI systems. These technologies will enable banks to deliver personalized services and proactive risk management, ultimately enhancing the customer experience. By prioritizing responsible AI deployment, financial institutions can ensure that their transformations are not only efficient but also ethical and trustworthy.

The journey towards a more agile and customer-centric banking environment is underway, positioning the industry for continued success in the digital age.