Introduction

The banking sector is undergoing a profound transformation, driven by the integration of digital technologies and the rise of financial technology (fintech). Traditional banks, which have long been the cornerstone of economic stability, are adapting to a rapidly changing landscape characterized by digital banking, offshore banking, and an increased focus on risk management. As financial institutions navigate these changes, they are leveraging automation, artificial intelligence (AI), and machine learning to enhance efficiency, improve customer experiences, and ensure compliance with evolving regulations.

This article explores the key functions of banking, the core operations that sustain financial institutions, the role of automation in loan processing, the importance of compliance and security measures, and future trends shaping the industry. By understanding these dynamics, banking leaders can better position their organizations for success in an increasingly digital world.

Key Functions of Banking

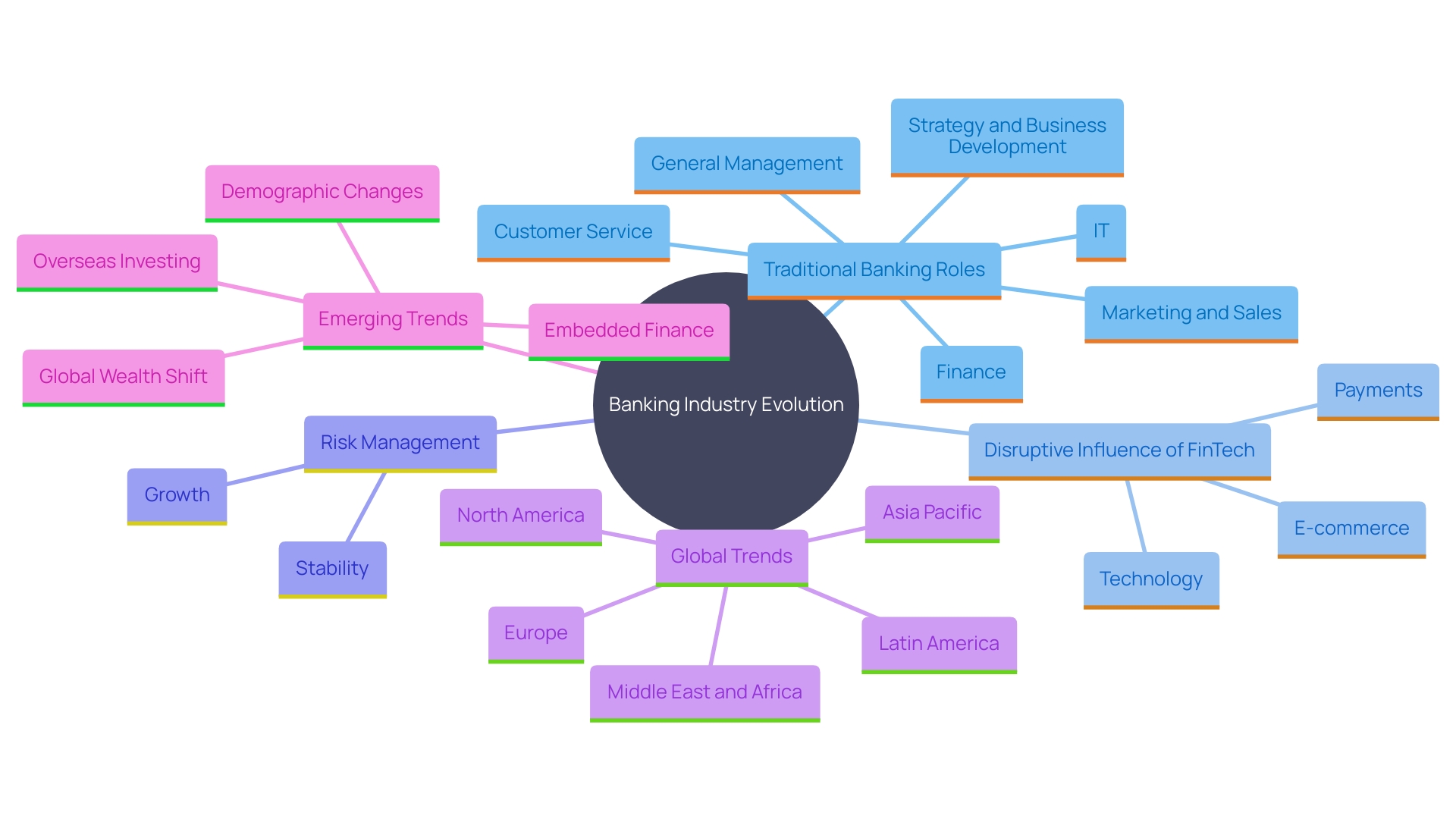

The banking industry plays a crucial role in the economic ecosystem by changing the way we conduct transactions, manage investments, and access monetary resources. Traditional banks have been the backbone of economic stability, offering essential services such as accepting deposits, providing loans, facilitating payments, and delivering investment opportunities. However, the rise of financial technology, or FinTech, has significantly disrupted these traditional roles, ushering in a new era of innovation.

Digital finance has become a cornerstone of this transformation, compelling established institutions to adapt and innovate. ‘Offshore financial services, for example, now provide advantages such as asset diversification, enhanced privacy, and tax efficiency, which appeal to both individuals and businesses.’. This evolution in banking services has been essential for supporting economic growth and stability, enabling more efficient management of resources.

Recent discussions in the financial sector underscore the importance of understanding the risk profiles, business models, and asset concentrations of financial institutions to assess their stability and viability. This focus on risk management is crucial, given that 30 percent of banks in emerging markets face high financial-sector risks within the next year.

The shift towards fintech and digital solutions in the financial sector is not just a trend but a necessity in an increasingly digital world. As these technologies continue to evolve, they promise to further enhance how individuals and businesses manage their resources, ultimately contributing to a more resilient and dynamic economic ecosystem.

Core Banking Operations

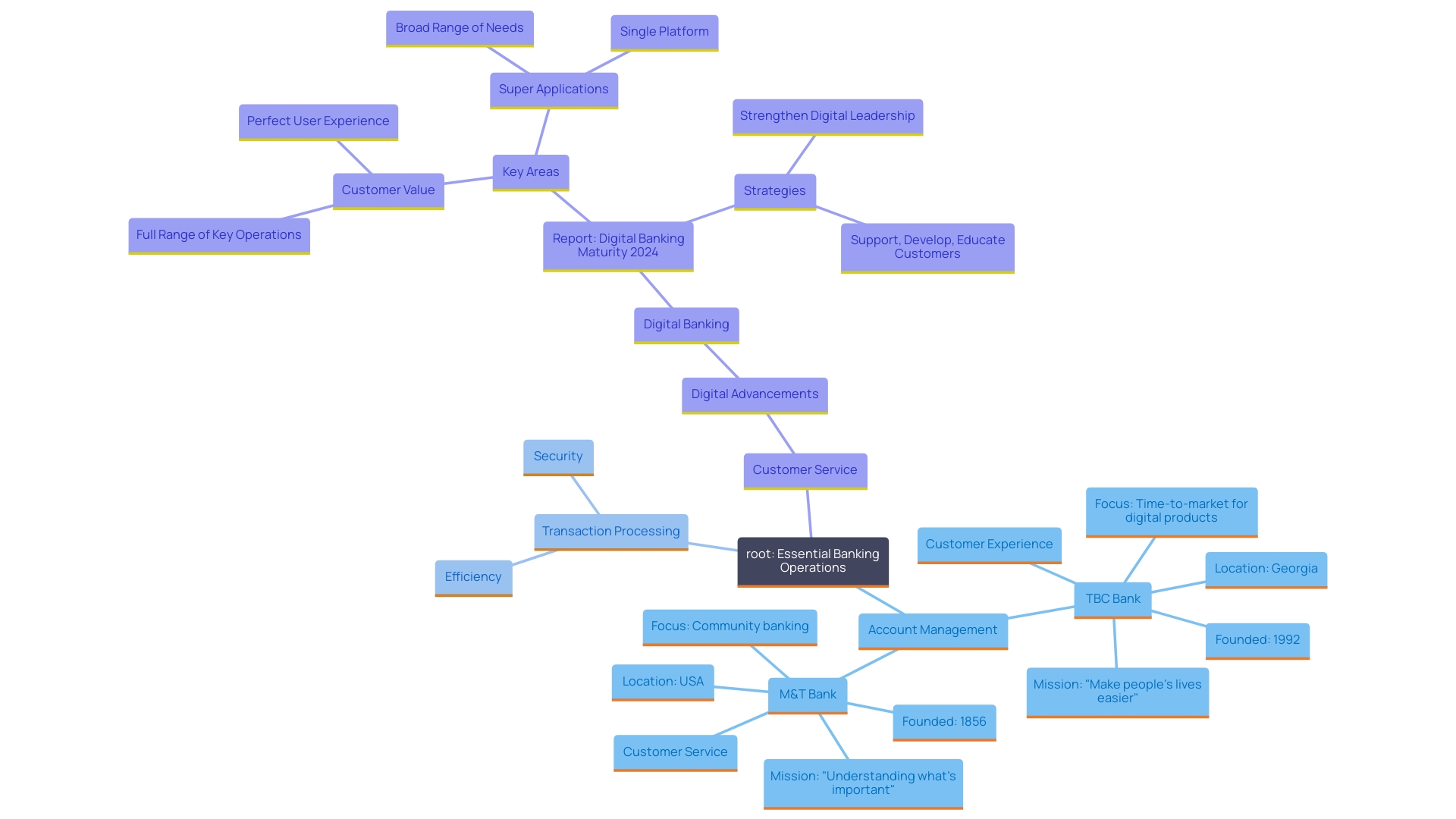

Essential operations, which encompass account management, transaction processing, and customer service, are the heartbeat of any monetary institution. With the advent of modern technology, these activities have become more streamlined and efficient, significantly reducing the time and resources required to complete routine tasks. For instance, TBC Bank, a prominent financial institution in Georgia, has utilized digital advancements to enhance the time-to-market for its products, ensuring an exceptional service experience for both customers and employees.

The shift towards digital banking is not just a trend but a necessity driven by changing consumer habits and competitive pressures. M&T, a leading U.S. commercial institution, has been at the forefront of this transformation, adopting stringent security measures and regulatory compliance to protect sensitive data and transactions. ‘This digital shift has enabled financial institutions to offer a full range of key operations, from seamless user experiences to comprehensive ‘super applications’ that meet diverse customer needs on a single platform.’.

‘The Economist Impact study highlights that financial leaders are focusing on delivering exceptional value to customers while integrating digital tools to enhance the overall experience.’. Digital technologies are transforming every aspect of financial services, from customer interactions to backend operations, ensuring that institutions can function effectively and efficiently in a rapidly evolving economic landscape.

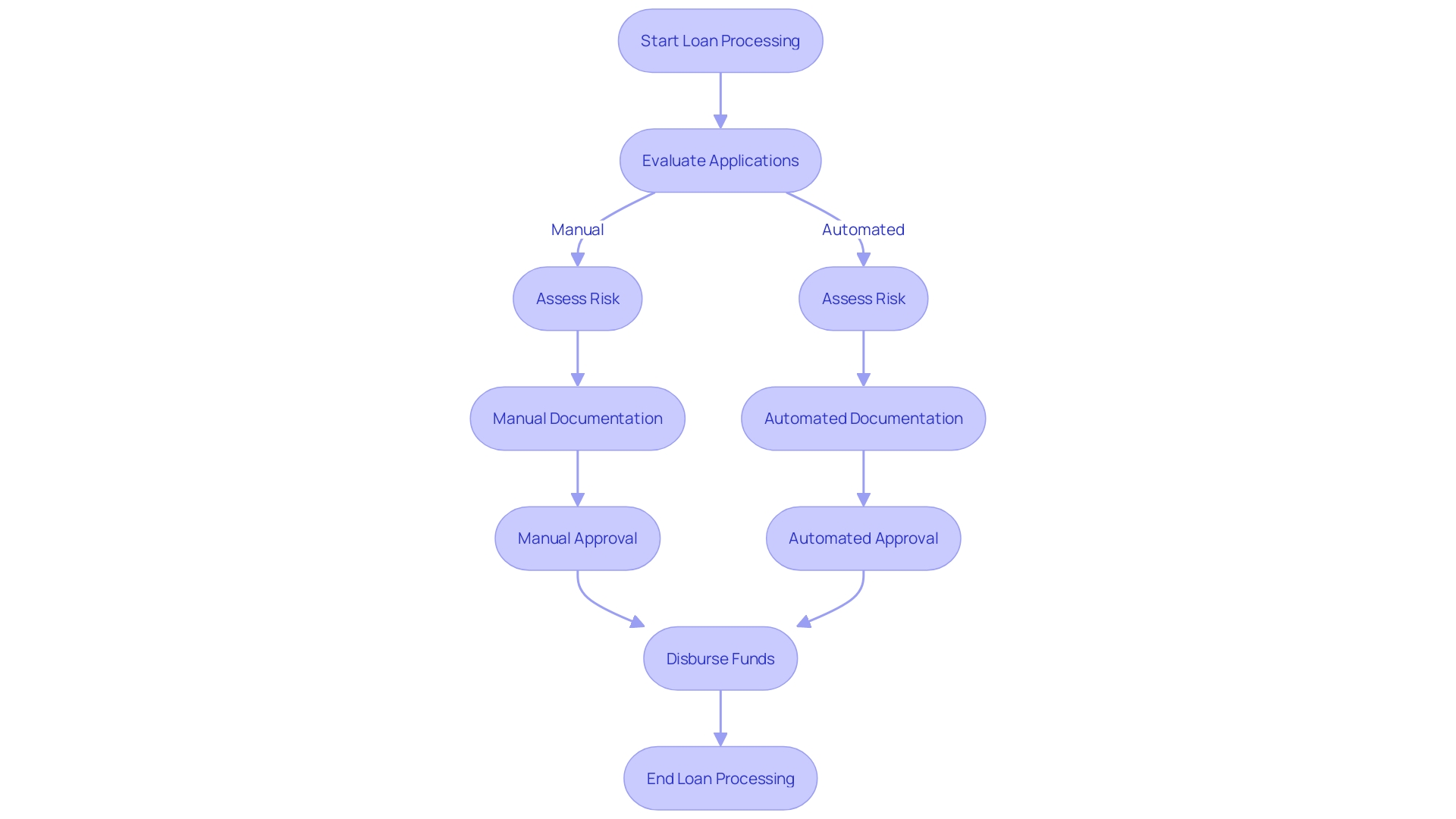

Loan Processing

Loan processing involves evaluating applications, assessing risk, and disbursing funds. Automation has transformed this essential function, allowing financial institutions to analyze data rapidly, make informed lending decisions, and significantly enhance customer experience with faster turnaround times. For instance, the automation of underwriting has streamlined workflows in insurance and financing, boosting productivity and operational efficiency by eliminating time-consuming manual tasks. According to Accenture, early adopters of automation in the financial sector could see a 73% improvement in productivity over the next three years. This technology is reshaping the industry, enabling smarter decision-making and increasing transparency. As Shelli Girard, Vice President of Software Development at Sagent, highlights, AI and automation are revolutionizing the industry, making processes faster and more efficient. By leveraging these advancements, financial institutions can offer better services and maintain a competitive edge in today’s fast-paced financial landscape.

Compliance and Security Measures

Ensuring compliance with regulations is critical in banking. Automation tools, powered by artificial intelligence (AI) and machine learning (ML), enable institutions to monitor transactions, manage risk, and maintain security protocols with unprecedented efficiency. For example, M&T Bank, with its 165-year history, has adopted Clean Code standards to maintain software quality and compliance, ensuring smooth operations and protecting against potential threats.

AI systems can track changes in legislation in real-time, assisting financial institutions in adjusting their compliance strategies promptly. This ability is essential as the monetary sector often undergoes regulatory shifts. According to Adrian Crockett from Microsoft Cloud, hybrid intelligence improves efficiency in tasks such as end-of-day reporting to regulatory authorities, which previously required significant human capital.

The importance of robust fraud prevention cannot be overstated, especially with 74% of organizations falling victim to payment scams last year. Losses are expected to reach $206 billion over the next four years, underscoring the need for advanced fraud detection mechanisms. Traditional rule-based systems are often inadequate for tackling sophisticated fraud schemes. By leveraging AI and ML, financial institutions can detect complex fraud patterns and enhance their fraud prevention strategies, thus maintaining customer trust and organizational integrity.

Banks like Arab National Bank have embraced digital transformation to stay ahead of the curve. With ambitious strategies, they aim to deliver top-notch monetary services while ensuring compliance and security. This forward-looking approach not only safeguards sensitive customer information but also strengthens the institution against the constantly changing environment of financial threats.

The Role of Automation in Banking Operations

Automation significantly enhances efficiency and accuracy in banking operations. By minimizing manual tasks, financial institutions can drastically reduce errors, lower operational costs, and redirect resources toward strategic initiatives. For instance, Capital One’s transition to a cloud-based infrastructure has driven innovation and digital transformation, allowing over 50,000 employees to collaborate and automate work seamlessly. Furthermore, institutions such as M&T emphasize upholding high software quality standards to guarantee seamless operations and compliance, avoiding expensive security breaches and financial losses.

The benefits of automation extend across various sectors within banking. According to a report by Accenture, 73% of the time spent by US bank employees could be impacted by automation, affecting nearly every role from the C-suite to the front lines. This potential for productivity improvement is substantial, with early adopters expected to see significant gains in the next three years. ‘The application of machine learning and AI further drives this transformation, as seen in the adoption of technologies like pandas and TensorFlow for data examination and modeling.’.

Furthermore, the swift acceptance of generative AI in boardrooms highlights its significance in the economic sector. A survey revealed that 98% of respondents from financial services organizations consider generative AI a top agenda item, highlighting its potential to enhance profitability and operational efficiency. Automation is not just a trend but a transformative shift, reshaping the way banks operate and interact with technology.

Future Trends in Banking Operations

The future of banking operations is rapidly advancing towards digital transformation, driven by the integration of cutting-edge technologies. Trends such as artificial intelligence (AI), machine learning, and blockchain are set to greatly transform the industry, encouraging innovation and creating new opportunities for financial sectors. According to Accenture’s analysis, 73% of the time spent by US bank employees could be impacted by generative AI, with 39% attributed to automation and 34% to augmentation. This potential spans across the entire banking spectrum, from the C-suite to frontline services.

The rise of monetary technology, or FinTech, is central to this transformation. Traditional financial institutions face mounting pressure to adapt and innovate in response to these disruptive developments. AI, especially, is becoming essential in the Banking, Financial Services, and Insurance (BFSI) sector, altering the way products and offerings are provided. AI-powered systems enhance cybersecurity by analyzing vast amounts of data in real-time, detecting anomalies, and identifying potential threats, thereby safeguarding sensitive customer information.

Furthermore, as AI continues to integrate into daily operations, companies must stay competitive in an AI-driven world. Generative AI is already being adopted widely, with the highest usage in marketing and sales (34%) and product or service development (23%). This shift not only promises a transformative journey but also highlights the critical balance between innovation and responsibility, setting the stage for a future where finance is more efficient, customer-centric, ethical, and inclusive.

Conclusion

The banking sector stands at a crossroads, driven by the integration of digital technologies and the rise of fintech. Traditional banks are redefining their roles and operations to meet the demands of an increasingly digital landscape. Key functions such as transaction processing, risk management, and customer service are evolving, with automation and artificial intelligence playing pivotal roles in enhancing efficiency and customer experiences.

This transformation is essential not only for maintaining economic stability but also for fostering innovation and resilience within the financial ecosystem.

Core banking operations have become more streamlined, allowing institutions to respond swiftly to changing consumer needs while ensuring compliance and security. Automation in loan processing has revolutionized decision-making, enabling banks to provide faster services and improve operational efficiency. The focus on compliance and security measures has intensified, as advanced technologies help institutions navigate the complexities of regulatory requirements and protect against fraud.

Looking ahead, the future of banking operations is being shaped by emerging trends in AI, machine learning, and blockchain technology. These innovations promise to enhance service delivery and operational capabilities, creating a more customer-centric and efficient financial environment. As the industry adapts to these changes, banking leaders are empowered to embrace a proactive approach, leveraging technology to not only meet challenges but also seize new opportunities for growth and success.