Introduction

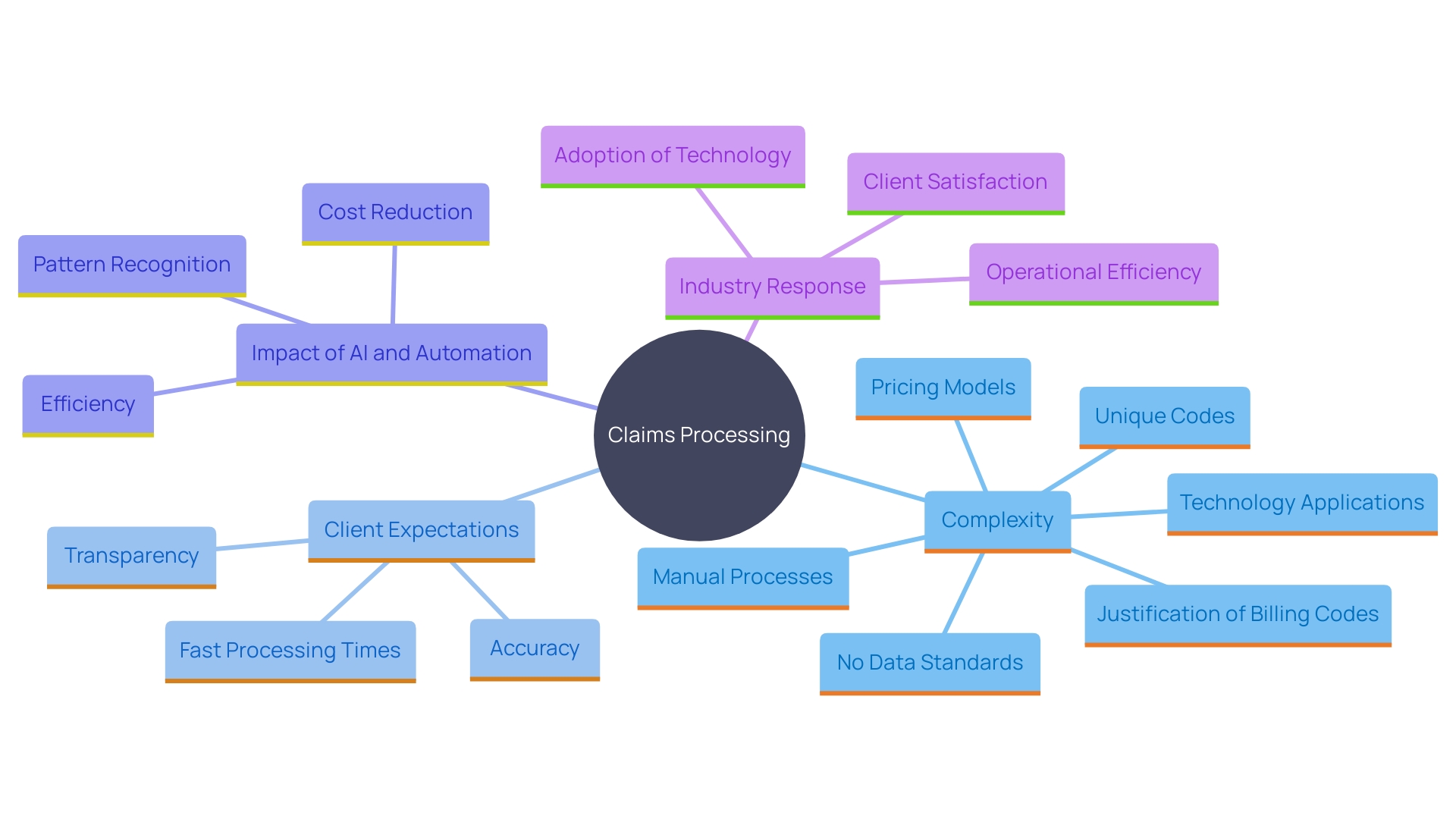

Navigating the complexities of filing an insurance claim can be a daunting task, especially when dealing with intricate policy details and stringent documentation requirements. This article demystifies the process of submitting claims with Old Mutual, providing a comprehensive guide that spans from understanding your policy to troubleshooting common issues. By leveraging advanced technologies such as artificial intelligence and intelligent document processing, the insurance industry is transforming the claims experience, offering quicker resolutions and enhanced customer satisfaction.

Dive into the practical steps and insights outlined below to ensure a seamless and efficient claims process, empowering you to handle your insurance claims with confidence and clarity.

Understanding Your Policy Details

Before starting a request procedure, it’s crucial to carefully examine your insurance agreement. Comprehending the coverage limits, exclusions, and specific conditions related to requests can prevent disappointments and delays. For instance, a case involving Travel Insured International highlighted how misinterpretation of contract terms, such as financial default and cancellation clauses, can lead to claim denials. The individual holding the insurance faced significant legal battles and was ultimately denied coverage, underscoring the importance of understanding your plan inside out.

It’s also crucial to wait for approval from your insurance company before undertaking any actions or repairs, as these may not be included in your coverage. Numerous regulations have stringent rules regarding the time frame for submitting a request, and failing to meet this deadline can lead to automatic rejection. Multiple submissions for the same request can also result in rejections, causing unnecessary delays.

Considering these difficulties, understanding your coverage specifics enables you to manage the requests efficiently and establishes practical expectations. Always consult with insurance experts and leverage available resources to clarify any uncertainties in your coverage.

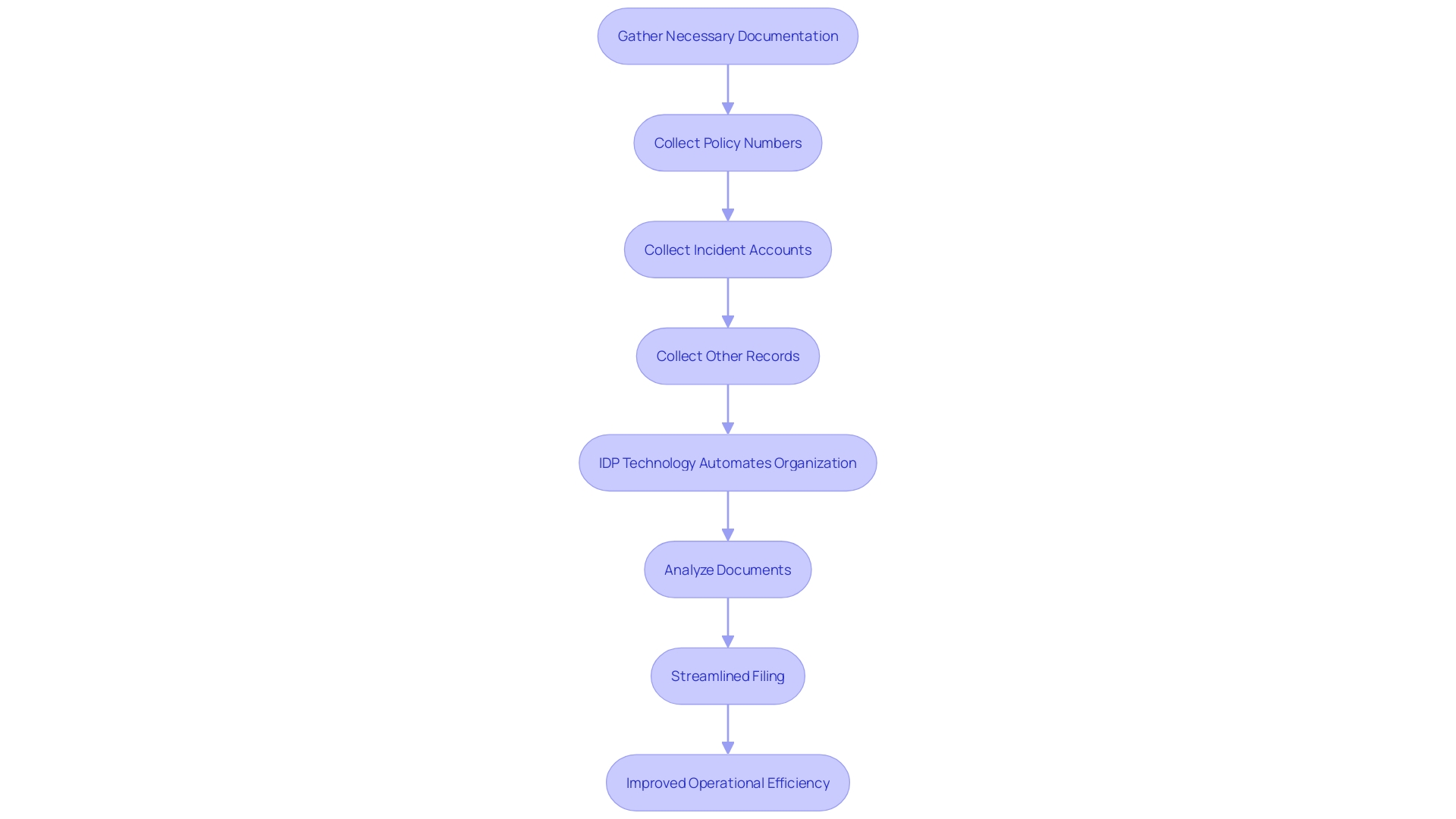

Gathering Required Documents for Claims

To ensure a smooth and efficient claims procedure, it’s essential to gather and organize all necessary documentation beforehand. This typically includes your policy number, detailed accounts of the incident, photographs, receipts, and any other pertinent records. By having these documents readily available, you can significantly streamline the filing procedure and minimize potential delays. Intelligent document processing (IDP) technology, which utilizes machine learning algorithms and artificial intelligence, can further improve this workflow by automating the organization and analysis of these documents. According to Forrester’s research, the right solutions in intelligent document processing provide a competitive edge in the insurance industry. This technology decreases manual labor, lessens human error, and enables quicker resolution of requests, ultimately enhancing operational efficiency and customer satisfaction. As Munish Arora from Sun Life notes, businesses aim for end-to-end process automation to enhance client experience, which is achievable by addressing the challenges of unstructured data. By utilizing IDP, you ensure that your documentation is not only organized but also efficiently processed, paving the way for quicker and more precise management of requests.

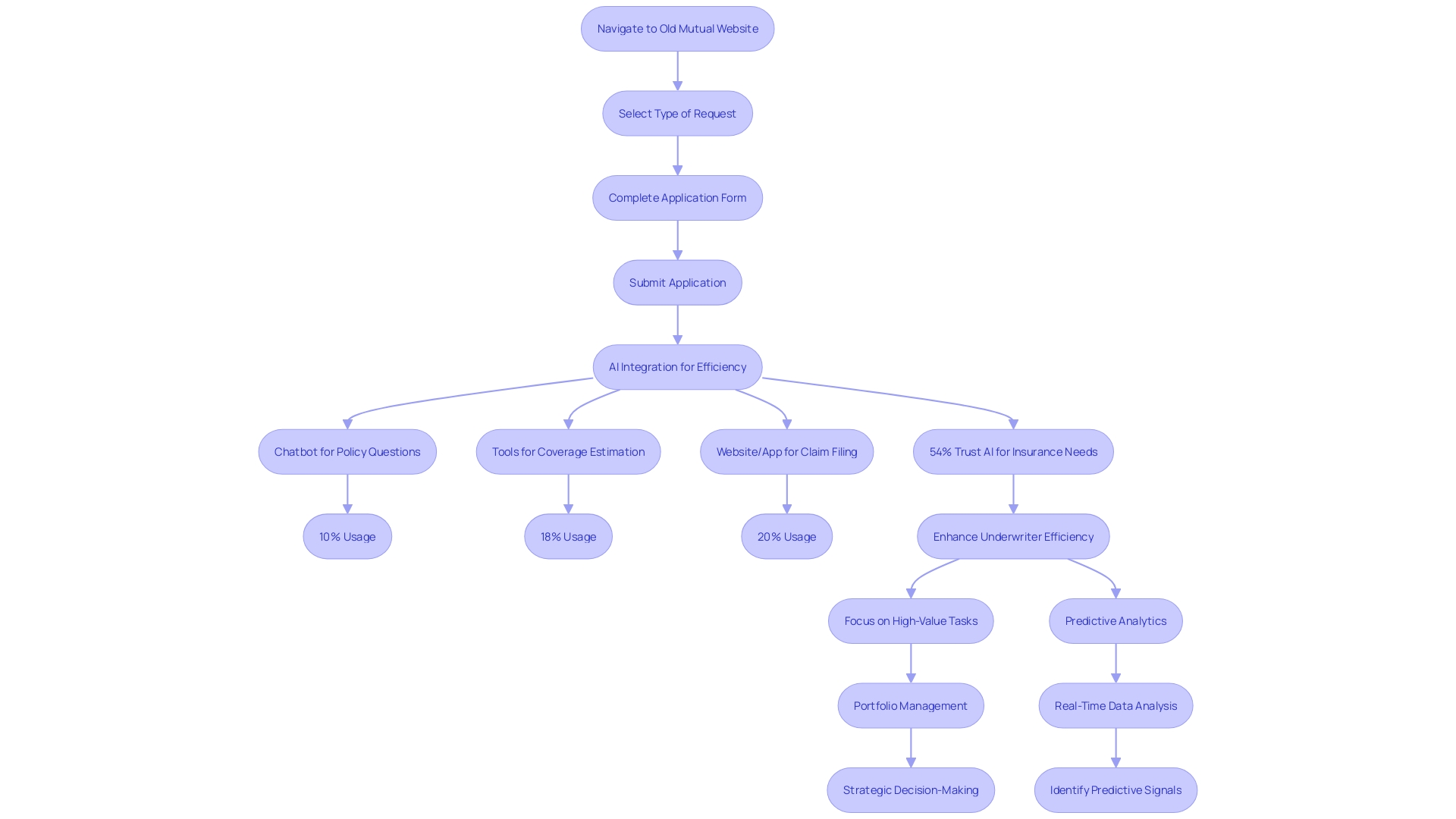

Step-by-Step Guide to Filing a Claim with Old Mutual

- Navigate to the Old Mutual website or contact their department directly. 2. Select the particular kind of request you need to submit. 3. Precisely complete the required application form, ensuring all essential details are included. 4. Submit your completed application form along with the required documentation either online or by mail, as specified. Embracing advanced technologies like artificial intelligence, Old Mutual is streamlining the process to enhance customer satisfaction and efficiency. According to Aleksander Czarnowski, a Senior Consultant at Sollers, insurers are increasingly investing in technology for managing cases to reduce handling costs and provide swift resolutions. This trend is evident in countries like the UK, Poland, and Germany, where digital and automated management of requests is becoming standard.

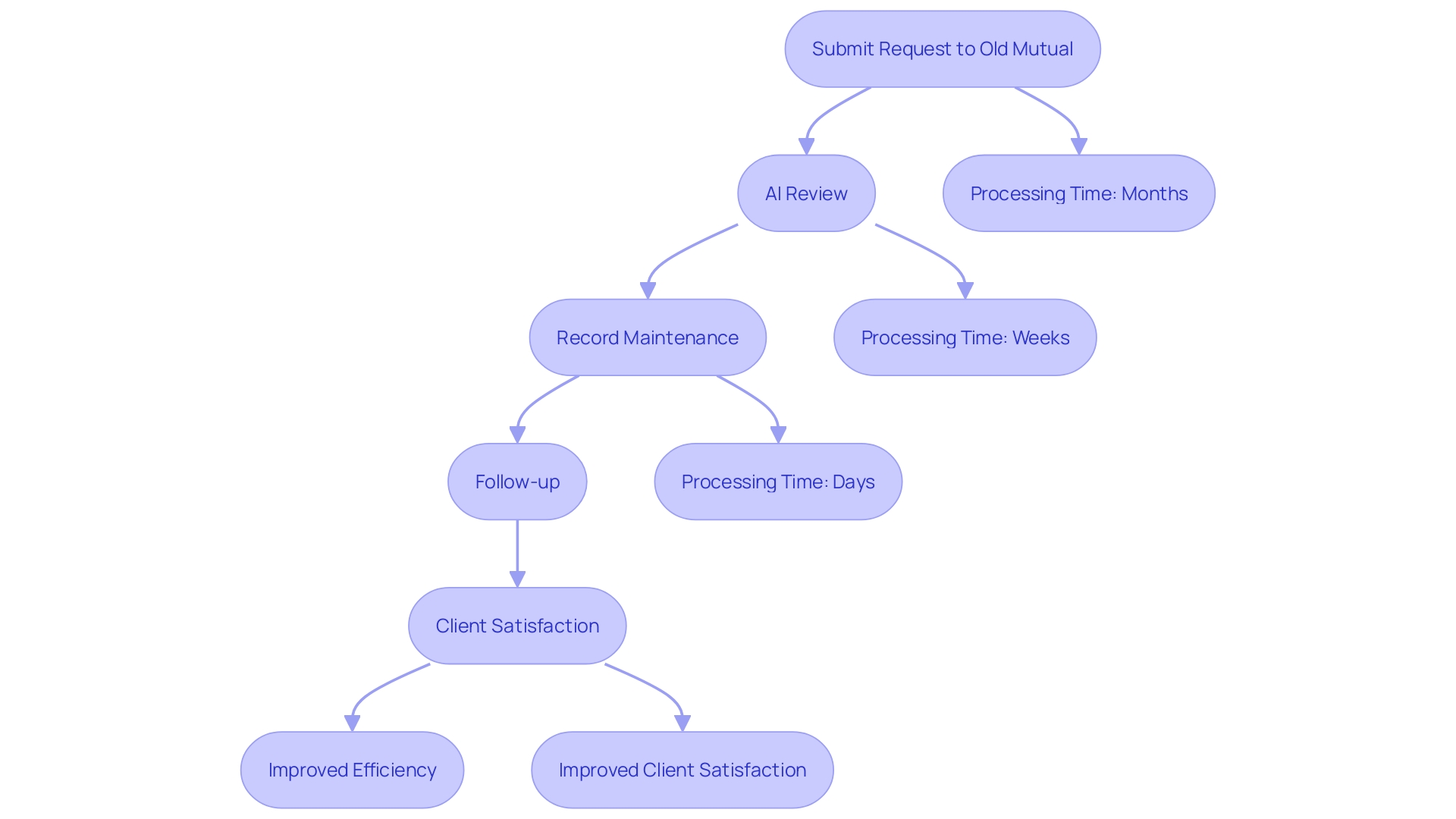

Submission and Processing of Claims

Once your request is submitted, Old Mutual will utilize advanced AI tools to review the documentation provided, significantly accelerating the process. Maintaining a record of your submission and any correspondence with the department is essential. This guarantees you can follow up if needed and monitor the advancement of your request. The application of AI has revolutionized the processing of requests, shortening what used to take months into just weeks or even days. This efficiency is evident in the insurance industry, where straight-through processing (STP) rates have surged from 37% to an impressive 60%, thanks to AI/ML integrations. Moreover, a survey discovered that 63% of clients prioritize rapid processing of requests, emphasizing the significance of prompt resolution of issues. By maintaining accurate records, you ensure a smoother experience and can address any issues promptly.

Timeline for Claims Processing and Payment

Claims processing times can vary greatly depending on the complexity of the case. However, with the ongoing advancements in automation and artificial intelligence, the insurance industry is making significant strides in reducing these times. Based on a recent study by Sollers Consulting and Ipsos, clients prioritize fast processing of requests, with 52% to 63% of participants in nations such as the UK, Germany, Poland, and France identifying it as one of their top three expectations. In the UK, this demand is particularly strong at 63%.

Artificial intelligence is becoming a common technology used to simplify management processes, especially in countries like the UK and Poland. This technology not only boosts the effectiveness of processing requests but also increases client satisfaction by delivering quicker replies and lowering management expenses.

Aleksander Czarnołęski, a Senior Consultant at Sollers, emphasizes that for clients, the solution to the problem is more important than the monetary compensation. This viewpoint emphasizes the importance for insurers to invest in technology for handling requests to satisfy client expectations efficiently. The survey emphasizes that insurers are acknowledging the significance of prompt request handling and are increasing their efforts to automate the system. This shift is crucial as it aligns with the industry’s need to evolve rapidly in response to changing customer demands and the competitive landscape.

Troubleshooting Common Issues with Claims

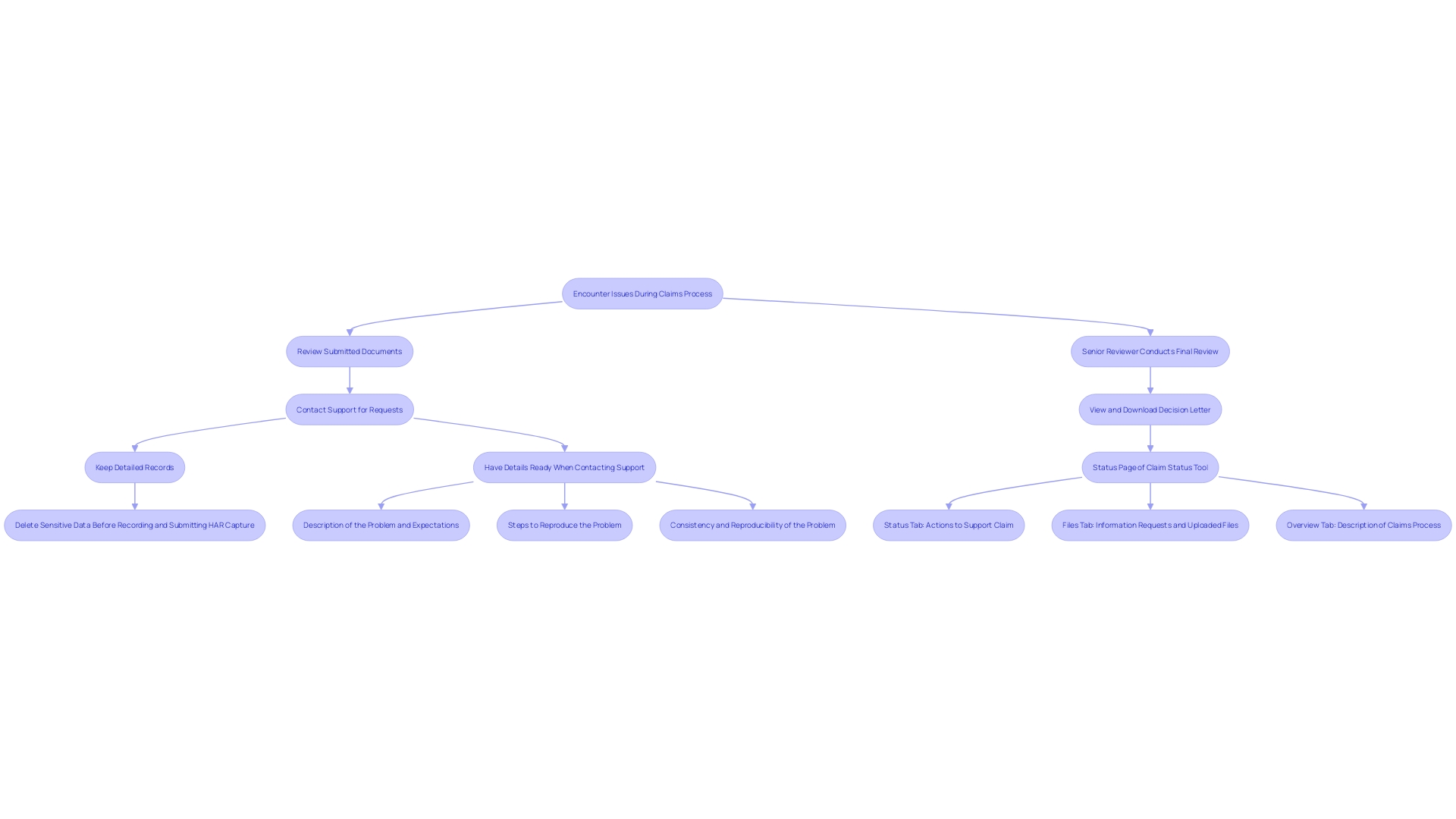

If you encounter issues during the claims process, such as delays or lack of communication, consider the following steps to streamline resolution:

- Review Your Submitted Documents: Ensure all submitted documents are accurate and complete. Errors or missing information can cause unnecessary delays.

- Contact Support for Requests: Reach out to Old Mutual’s support for clarification. Updating the request handling with technology can greatly enhance response times and precision.

- Keep Detailed Records: Maintain thorough records of all communications. This helps track progress and facilitates quicker resolution in case disputes arise.

As the insurance sector develops, incorporating AI and automation can boost the effectiveness of the processing system, minimizing the duration spent on administrative duties and enhancing client satisfaction.

Contact Information for Old Mutual Claims Support

For smooth help with your insurance requests, Old Mutual’s support team is easily reachable via their service hotline or their official website. With the increasing demand for faster processing of requests, as highlighted by a recent survey showing that 63% of customers in the UK prioritize quick responses, it’s crucial to have your policy number on hand for expedited service. This approach ensures a smoother experience, meeting the high expectations for prompt and efficient claims handling.

Conclusion

Understanding the intricacies of the insurance claims process is vital for achieving successful outcomes. A thorough review of policy details lays the foundation for effective navigation, ensuring that all coverage aspects are understood and adhered to. This knowledge empowers individuals to avoid common pitfalls that can lead to claim denials and delays, reinforcing the importance of consulting with experts when uncertainties arise.

Organizing and submitting the required documentation is another crucial step in the claims process. The integration of intelligent document processing technologies enhances efficiency, allowing for accurate and timely claims management. By preparing all necessary documents in advance, individuals can significantly streamline their claims submissions and improve the likelihood of prompt resolutions.

The use of advanced technologies, such as artificial intelligence, is revolutionizing how claims are processed. These innovations not only reduce the time needed for claims handling but also enhance customer satisfaction. Maintaining clear communication and detailed records throughout the process ensures that any issues can be swiftly addressed, further contributing to a smoother experience.

In conclusion, navigating the claims process with Old Mutual—or any insurer—requires a proactive and informed approach. By understanding policy details, gathering necessary documentation, and leveraging technology, individuals can empower themselves to manage their claims effectively, ultimately leading to quicker resolutions and improved satisfaction.