Introduction

In the rapidly evolving world of finance, Digital Exchange Centers are emerging as transformative platforms that redefine how digital assets are traded and managed. By integrating advanced technologies such as blockchain, artificial intelligence, and Robotic Process Automation, these centers not only enhance security and efficiency but also democratize access to financial markets.

As organizations navigate this new landscape, the importance of operational agility and data-driven insights becomes paramount. With the market for stablecoins reaching unprecedented heights and the rise of decentralized finance, businesses must adapt to stay competitive.

The article explores the pivotal role of Digital Exchange Centers in reshaping financial transactions, the technological innovations driving their success, regulatory challenges, and what the future holds for this dynamic sector.

Embracing these changes can empower organizations to thrive in an increasingly digital economy.

Defining the Digital Exchange Center: A New Era in Finance

A digital exchange center functions as a cutting-edge platform that revolutionizes the exchange of digital assets, including cryptocurrencies, tokens, and other financial instruments. This innovative approach marks a pivotal shift from traditional exchanges towards decentralized, technology-enabled environments like a digital exchange center. Notably, stablecoins have hit a record market cap of $190 billion, underscoring the growth and relevance of digital assets in the current market.

By harnessing advanced technologies such as blockchain, artificial intelligence, and Robotic Process Automation (RPA), the digital exchange center significantly enhances security, transparency, and efficiency in transaction processes. RPA specifically reduces errors and frees up teams for more strategic, value-adding work, fostering a more agile business environment. As David Marino-Nachison noted, ‘Bitcoin trades near $66,000 as crypto stocks rise,’ reflecting the dynamic nature of the cryptocurrency market.

The streamlined transaction workflows at the digital exchange center, enhanced by RPA, create an environment where users—from individual investors to large financial institutions—can engage in trading activities with greater confidence and reduced friction. Furthermore, the case study titled ‘Why Blockbuster Games Will Soon Be Built on Modular Appchains’ emphasizes the need for horizontally scalable blockchain solutions, indicating the evolving landscape and its implications for digital asset exchanges. As organizations strive to enhance operational efficiency through tailored AI solutions and Business Intelligence, which transform raw data into actionable insights, embracing the concept of Digital Collaboration Centers becomes crucial to staying competitive and responsive to ever-changing market dynamics.

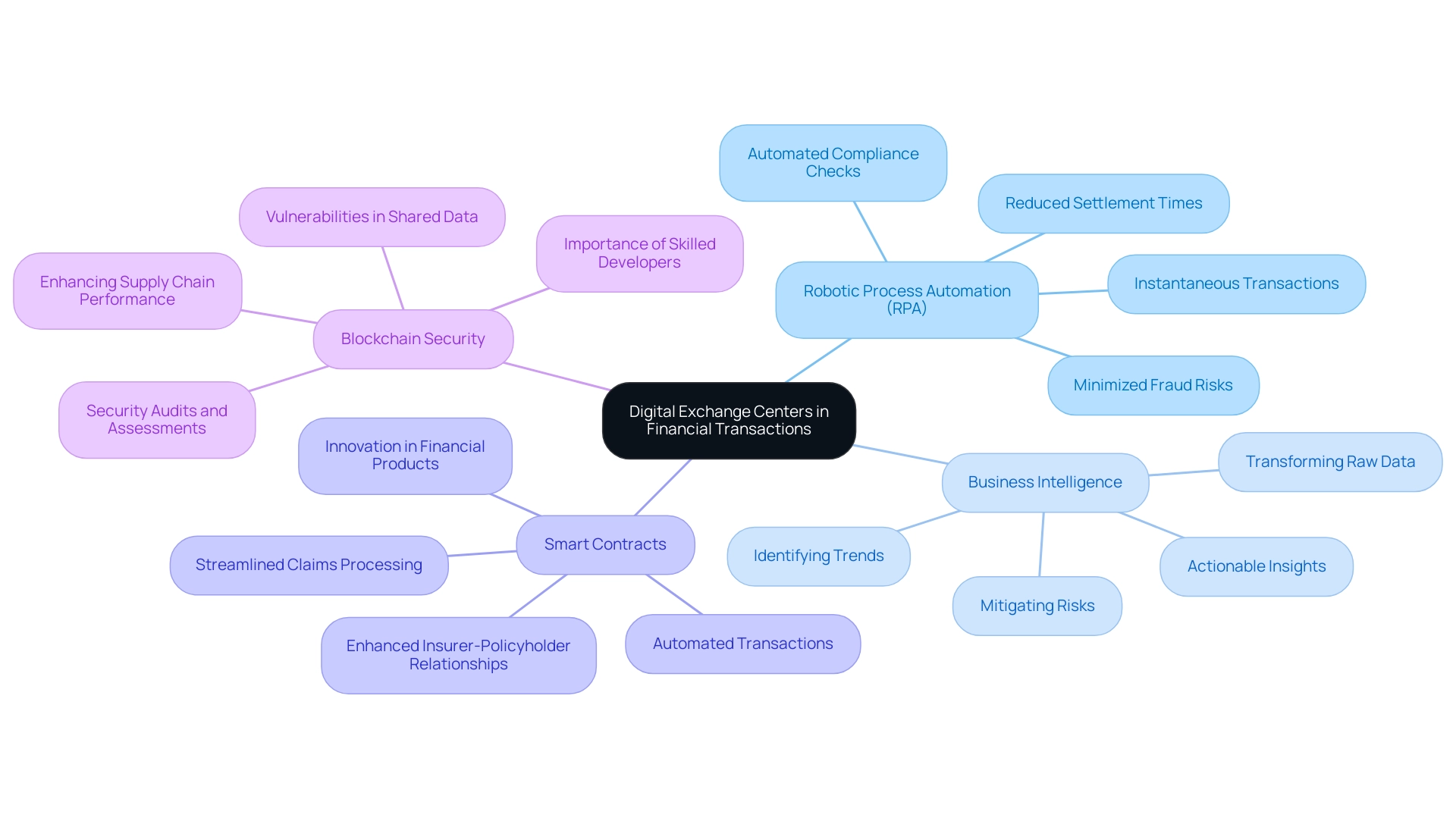

The Role of Digital Exchange Centers in Transforming Financial Transactions

Digital exchange centers are transforming financial transactions by utilizing advanced methods to enhance speed, security, and accessibility. By incorporating Robotic Process Automation (RPA), these platforms facilitate instantaneous transactions, drastically reducing settlement times and minimizing fraud risks through robust security protocols. This not only democratizes access to financial markets but also frees up teams to focus on strategic tasks, enhancing operational efficiency.

Additionally, the integration of Business Intelligence allows organizations to transform raw data into actionable insights, enabling informed decision-making that drives growth and innovation. For instance, financial institutions can utilize RPA to automate routine compliance checks, while Business Intelligence tools analyze transaction data to identify trends and mitigate risks. The implementation of smart contracts automates transactions based on predefined conditions, streamlining processes and improving business productivity.

Beyond trading, smart contracts are transforming the insurance industry by simplifying claims processing and strengthening relationships between insurers and policyholders. This shift fosters innovation in financial products and services while equipping organizations to adapt swiftly to evolving consumer demands and dynamic market conditions. The significance of these centers is accentuated by the potential for data-driven insights, as evidenced by the fact that 95% of the medical data in Estonia has been digitized.

However, the shared nature of blockchain data can expose organizations to vulnerabilities, making the hiring of skilled blockchain developers critical. As one industry expert noted, ‘Network members look for ways to leverage the use of the blockchain to improve supply chain performance in areas such as efficiency, freshness, waste reduction, and certification verification.’ This highlights the significance of security audits and assessments carried out by internal developers to maximize the potential of blockchain.

As more companies recognize the myriad benefits of the digital exchange center, the integration of RPA, tailored AI solutions, and Business Intelligence into operational strategies will likely become a priority, enhancing competitiveness and driving sustainable growth.

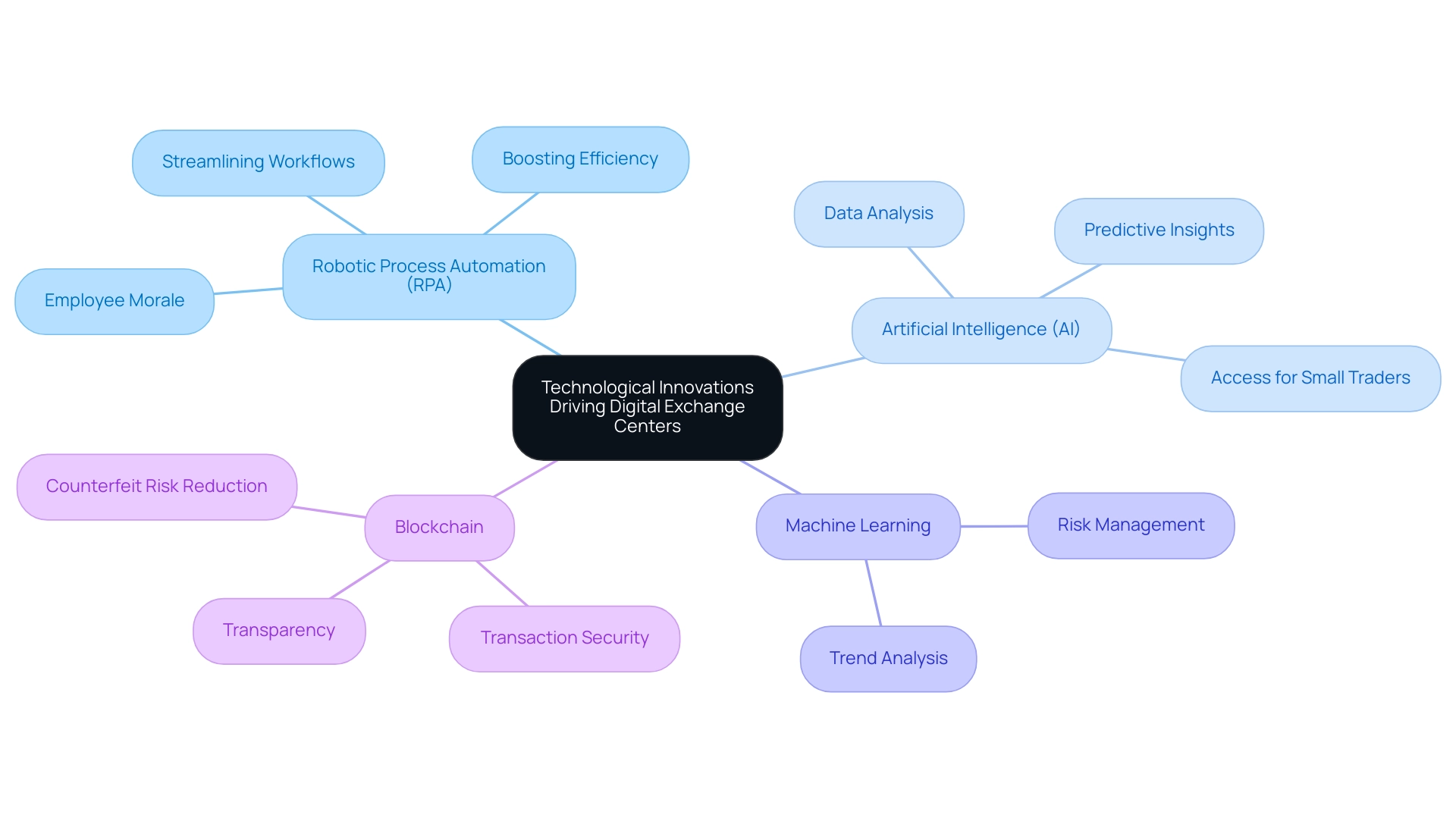

Technological Innovations Driving Digital Exchange Centers

Innovative advancements such as robotic process automation (RPA), artificial intelligence (AI), and machine learning are transforming Digital Exchange Centers, which are essential for enhancing operational efficiency. RPA addresses critical challenges like task repetition fatigue and staffing shortages, allowing firms to streamline their workflows. Companies such as NASDAQ are utilizing AI and blockchain innovations to enhance the security and efficiency of stock operations, showcasing the practical advantages of these advancements.

RPA tools like EMMA RPA and Microsoft Power Automate streamline repetitive tasks, boosting efficiency and employee morale by allowing teams to focus on more strategic initiatives. Blockchain technology secures and simplifies transactions through an immutable ledger, enhancing transparency and significantly reducing the risk of counterfeit assets. This security foundation fosters greater trust among market participants.

Meanwhile, AI and machine learning revolutionize strategies by analyzing vast datasets to uncover trends and deliver predictive insights, empowering traders to make informed decisions that optimize returns and manage risks effectively. For example, the ‘Benefits of AI for Small Traders’ case study illustrates how AI democratizes access to advanced trading strategies, enabling small traders to enhance their decision-making capabilities. Moreover, our customized AI solutions, featuring Small Language Models and GenAI Workshops, offer specialized tools to further enhance data quality and operational efficiency.

The ongoing integration of RPA, AI, and business intelligence is crucial for overcoming implementation challenges and driving informed decision-making, ensuring firms maintain a competitive edge in the rapidly evolving financial landscape. Book a free consultation to explore how we can help you leverage these technologies for your business success.

Regulatory Considerations for Digital Exchange Centers

As digital exchange centers continue to rise in prominence, they face the pressing challenge of navigating a multifaceted regulatory landscape that varies significantly across jurisdictions. Compliance with anti-money laundering (AML) practices and know your customer (KYC) requirements is not merely a legal obligation; it is critical for fostering trust with users and ensuring the long-term success of these platforms. Jesse Mudaliyar, Vice President at MasterCard, notes,

The establishment of a unified regulatory framework for AML and KYC presents a compelling solution.

This unified framework is essential not only for mitigating risks associated with non-compliance but also for enhancing the integrity of the financial system and combating criminal exploitation. The breach at Binance, where over 10,000 personal photographs were stolen, underscores the vulnerabilities in the system, highlighting the urgent need for robust compliance measures. Furthermore, recommendations for creating tailored legal frameworks in the cryptocurrency space emphasize the importance of establishing clear regulatory guidelines and mandatory compliance requirements.

By proactively addressing these regulatory considerations, businesses can enhance their reputation and cultivate a secure commerce environment. This effort not only aids in the development of digital exchange centers but also fosters their acceptance within the wider financial ecosystem, reinforcing the essential role of AML and KYC practices in digital transactions.

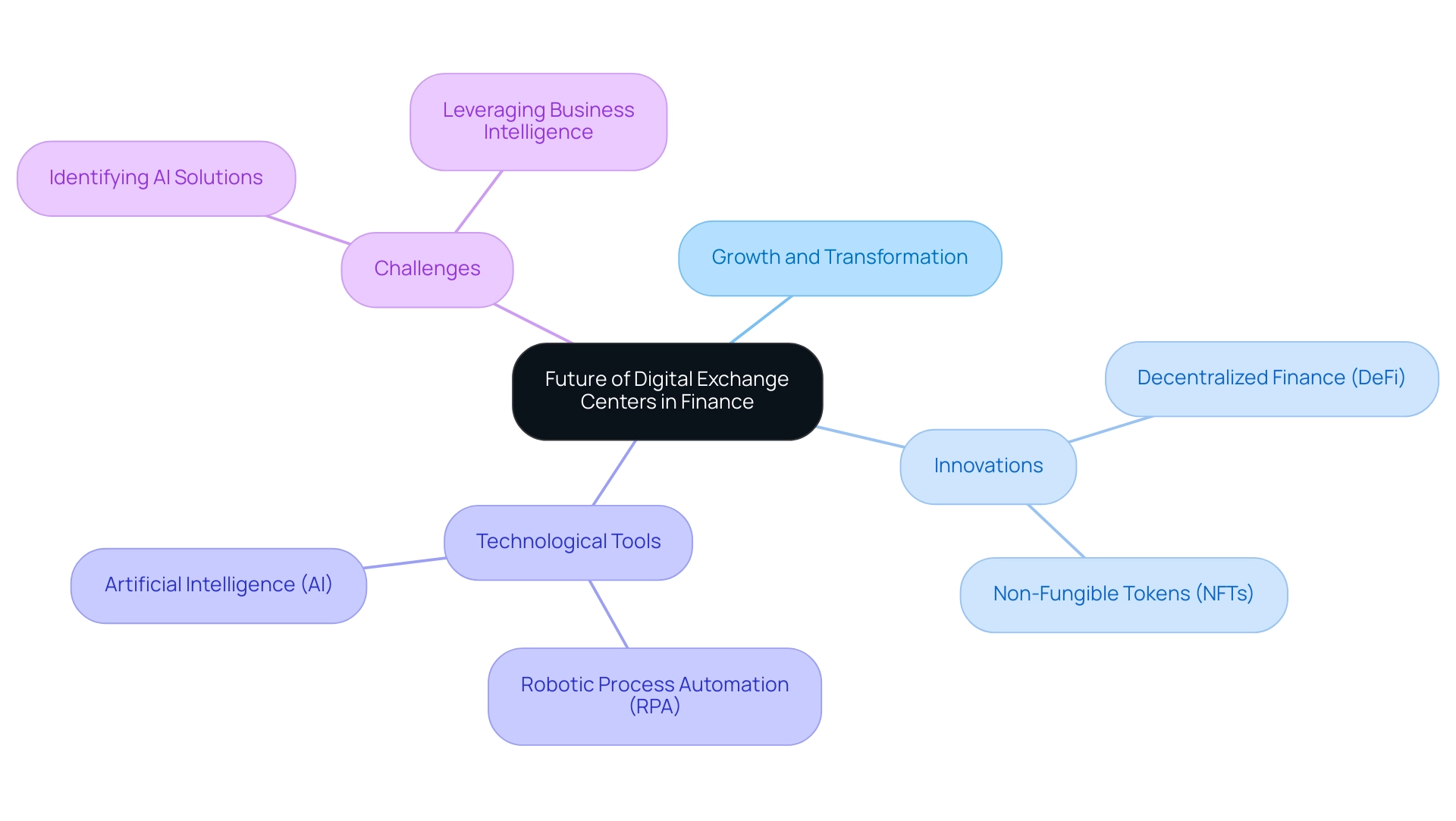

The Future of Digital Exchange Centers in Finance

The future of Digital Trading Centers is poised for significant growth and transformation as technology continues to advance and consumer preferences evolve. As more organizations acknowledge the advantages of digital asset exchange, we can anticipate a rise in the adoption of digital exchange centers across various sectors. Innovations like decentralized finance (DeFi) and non-fungible tokens (NFTs) are expected to further broaden the scope of Digital Market Centers, facilitating new forms of asset transactions and investment opportunities.

In this rapidly evolving landscape, leveraging Robotic Process Automation (RPA) will be crucial for organizations looking to streamline manual workflows and enhance operational efficiency. RPA can significantly reduce errors, improve productivity, and free up resources for more strategic tasks. Additionally, the integration of artificial intelligence will enhance personalized trading experiences, allowing users to tailor their strategies based on individual preferences and risk profiles.

However, organizations often face challenges in identifying the right AI solutions amidst a rapidly changing landscape. Furthermore, employing Business Intelligence tools is essential for extracting meaningful insights from vast data sets, as failing to leverage these insights can place organizations at a competitive disadvantage. As the financial landscape continues to evolve, organizations that embrace digital exchange centers, along with RPA and AI solutions, will be better positioned to thrive in an increasingly digital economy.

Conclusion

Digital Exchange Centers are at the forefront of a financial revolution, reshaping how digital assets are traded and managed. By harnessing advanced technologies like blockchain, artificial intelligence, and Robotic Process Automation, these platforms enhance security, efficiency, and accessibility, paving the way for a more democratized financial landscape. The integration of RPA not only streamlines transaction processes but also liberates teams to focus on strategic initiatives, thereby fostering operational agility. As evidenced by the growing market for stablecoins and the rise of decentralized finance, the momentum behind these centers is undeniable.

Navigating the complex regulatory landscape remains a critical challenge for Digital Exchange Centers, emphasizing the necessity for robust compliance measures. By proactively addressing anti-money laundering and know your customer requirements, organizations can build trust and secure their position in the market. The need for a unified regulatory framework is essential for mitigating risks and enhancing the integrity of the financial system, ensuring that Digital Exchange Centers can thrive in a secure environment.

Looking ahead, the future of Digital Exchange Centers is bright, with promising innovations on the horizon. As organizations increasingly recognize the benefits of digital asset trading, the adoption of these platforms is set to rise. Leveraging RPA and AI will be crucial in overcoming operational challenges and enhancing user experiences. By embracing these transformative technologies and remaining agile in a rapidly evolving financial landscape, businesses can position themselves for success, ensuring they not only survive but thrive in the era of digital finance.