Introduction

In the insurance industry, the landscape of operational efficiency is undergoing a profound transformation, driven by the strategic implementation of Business Process Management (BPM). As organizations grapple with the complexities of modern workflows, BPM emerges as a powerful tool that not only streamlines processes but also enhances compliance and customer satisfaction.

With the rise of low-code solutions and automation technologies like Robotic Process Automation (RPA), insurance companies are equipped to tackle repetitive tasks and inefficiencies head-on. This article delves into the essential components of BPM, the challenges faced during implementation, and the future trends that promise to redefine operational excellence in the sector.

By embracing these advancements, insurers can position themselves to meet the evolving demands of their customers while achieving significant cost reductions and improved service delivery.

Defining Business Process Management (BPM) in Insurance

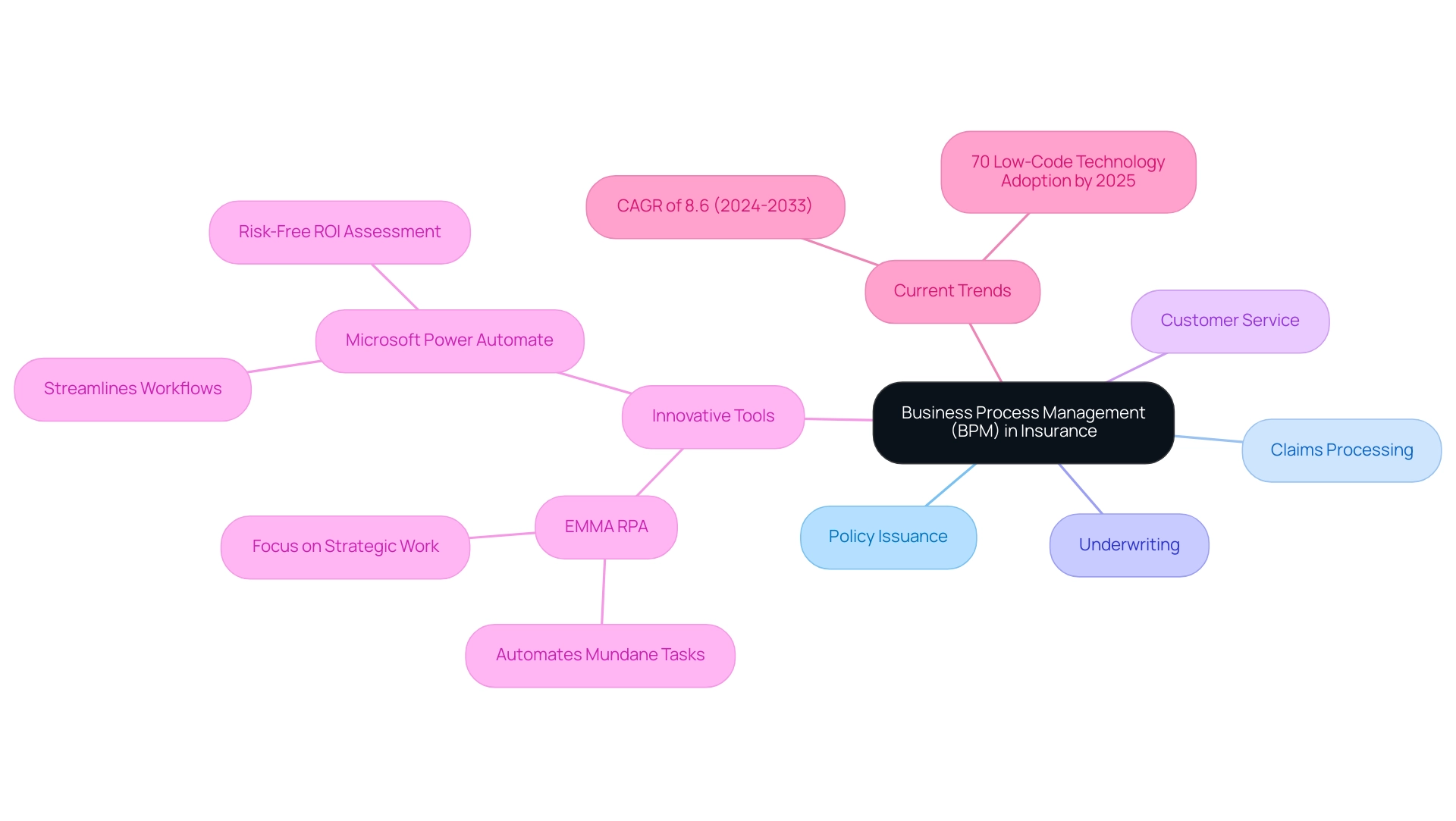

Business Process Management (BPM) in the financial sector is described as a systematic method focused on improving and overseeing the overall procedures that support insurance bpm. This encompasses critical functions such as:

- Policy issuance

- Claims processing

- Underwriting

- Customer service

Insurance BPM combines various methodologies, tools, and practices that allow companies in the insurance sector to analyze, design, execute, monitor, and enhance their workflows efficiently, including innovative Robotic Process Automation (RPA) solutions such as EMMA RPA and Microsoft Power Automate.

EMMA RPA specifically addresses task repetition fatigue by automating mundane tasks, allowing employees to focus on more strategic and value-adding work, while Power Automate streamlines workflows and ensures a risk-free ROI assessment through professional execution. The importance of insurance bpm is highlighted by its ability to improve efficiency, ensure compliance, and align with strategic objectives. This alignment elevates the customer experience while contributing to substantial cost reductions.

With an anticipated compound annual growth rate (CAGR) of 8.6% for the coverage services outsourcing market from 2024 to 2033, organizations are increasingly acknowledging BPM as a strategic resource for enhancement. Notably, Gartner anticipates that by 2025, low-code technology will drive over 70% of process management applications, a significant leap from less than 25% in 2020. This transition towards low-code solutions indicates an increasing need for user-friendly and integrated BPM systems, essential for improving efficiency within the sector.

Moreover, the banking, financial services, and risk management (BFSI) sector has the highest BPM adoption rate, with a market size of 35.6%, underscoring the significance and integration of insurance BPM methodologies alongside RPA and Business Intelligence in driving data-driven insights and efficiency for business growth.

The Importance of BPM for Operational Efficiency and Compliance in Insurance

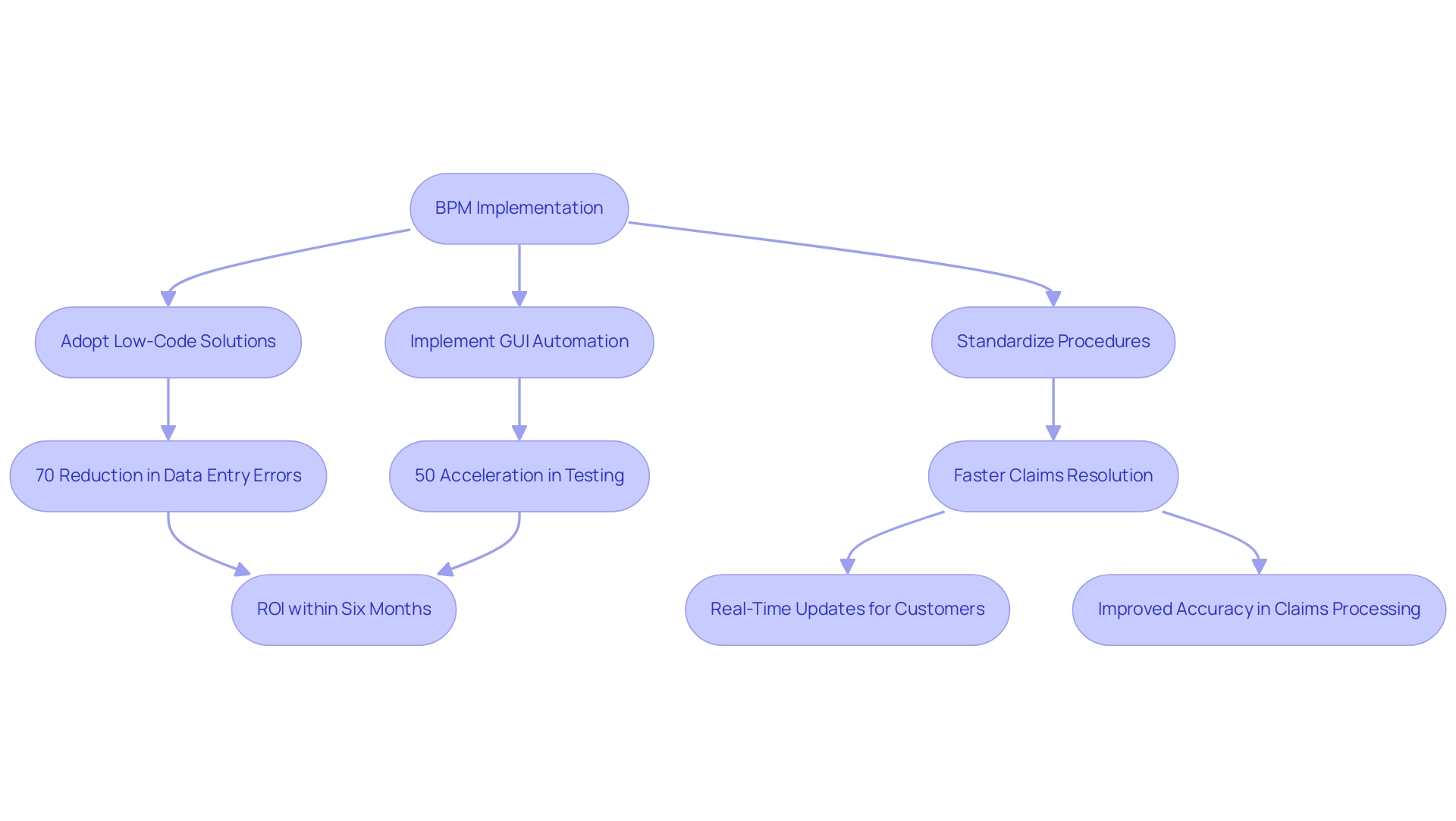

Business Process Management (BPM) is crucial for enhancing operational efficiency and ensuring compliance in the insurance bpm industry. With the rapid evolution of technology, especially the rise of low-code solutions—which, according to Gartner, will represent over 70% of management applications by 2025—insurance bpm provides companies with unprecedented opportunities to streamline their operations. A compelling example is illustrated by a mid-sized company that implemented GUI automation, overcoming challenges such as manual data entry errors and slow software testing.

This implementation not only resulted in a 70% reduction in data entry errors and a 50% acceleration in testing activities but also achieved a return on investment (ROI) within six months, underscoring the effectiveness of the solution. By standardizing procedures, organizations can effectively reduce redundancies and minimize errors, resulting in faster turnaround times for both policy issuance and claims handling. In the claims management system, insurance bpm can automate workflows by integrating multiple information sources, accelerating claims resolution and providing real-time updates to customers, fostering trust and enhancing satisfaction.

Furthermore, insurance bpm provides a robust framework for documenting processes, which is essential for adhering to stringent regulatory requirements in the sector. Beyond insurance, BPM solutions are also vital in complex fields like banking and electrophysiology, where high expertise and precision are required for optimal management efficiency. Companies leveraging Robotic Process Automation (RPA) and tailored AI solutions can achieve operational excellence, transforming raw data into actionable insights that drive informed decision-making.

By embracing these smart BPM solutions, organizations can build reliable and transparent systems that resonate with customer expectations and regulatory demands.

Key Components of BPM in Insurance

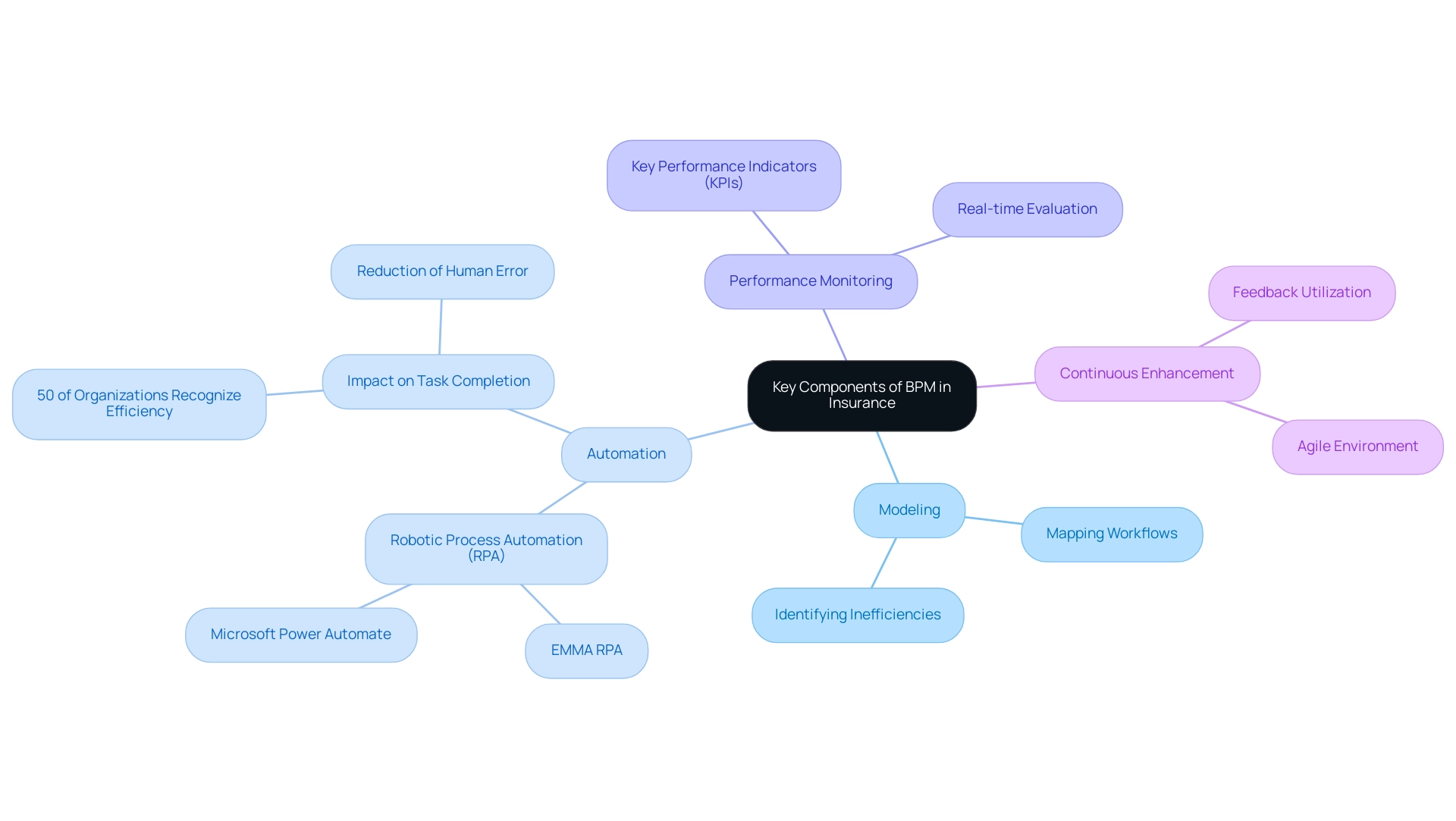

The foundational components of Business Activity Management (BPM) in the financial sector include:

- Modeling

- Automation

- Performance monitoring

- Continuous enhancement

Process modeling involves a thorough mapping of existing workflows to identify inefficiencies and opportunities for enhancement. This critical step enables organizations to visualize their operations, ensuring that no potential improvements are overlooked.

Significantly, 72% of business leaders in Europe attribute their business management efforts to improved customer satisfaction rates, highlighting the importance of insurance BPM in enhancing customer experiences. Automation, particularly through Robotic Process Automation (RPA) solutions like EMMA RPA and Microsoft Power Automate, plays a pivotal role in streamlining repetitive tasks while also addressing staffing shortages and outdated systems. By alleviating the burden of monotonous tasks, these solutions not only minimize human error but also significantly improve employee morale, as workers can focus on more meaningful and engaging activities.

In fact, 50% of organizations recognize that automation accelerates task completion, thereby enhancing overall operational efficiency. A practical example of insurance BPM in action can be observed in the case study titled ‘Executing the Underwriting Process,’ where the integration of automation solutions resulted in a unified data system that offers real-time access to information and improved policy pricing. Key features of EMMA RPA include its user-friendly interface that simplifies automation setup, while Microsoft Power Automate provides seamless integration with existing workflows to enhance productivity.

Performance monitoring is vital in this framework; utilizing key performance indicators (KPIs) and metrics enables a clear evaluation of effectiveness. Continuous improvement guarantees that systems are regularly refined based on real-time feedback and data analysis, fostering an agile environment. Furthermore, FBSPL’s coverage business process outsourcing services offer economical solutions that optimize efficiency and improve customer experience.

Collectively, these components establish a resilient insurance BPM framework that empowers firms to adapt swiftly to evolving market conditions and meet growing customer expectations, while also addressing the emotional and operational challenges posed by repetitive tasks.

Challenges in Implementing BPM in Insurance

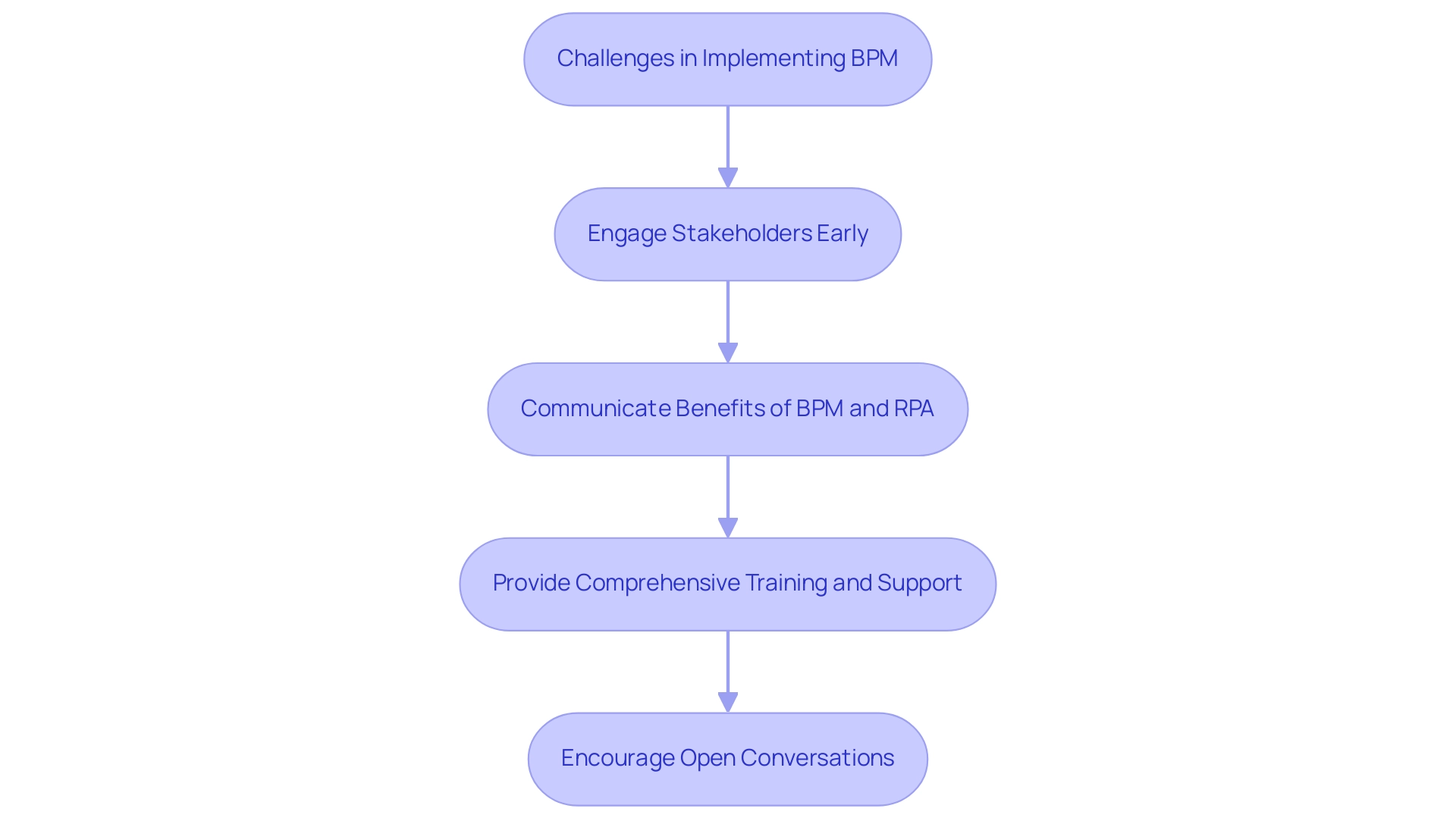

Implementing insurance BPM in the insurance sector presents several significant challenges. According to recent insights, employee resistance to change emerges as a primary obstacle, often fueled by fears of job displacement due to automation or concerns that new processes may lead to increased workloads. Furthermore, the lack of executive buy-in and insufficient training can hinder progress.

A report by Everest Group states that 40% of organizations are actively investing in AI-powered insurance BPM solutions to enhance efficiency, signaling a shift towards embracing these technologies. The rapidly evolving landscape of Robotic Process Automation (RPA) and tailored AI solutions can alleviate these concerns by streamlining manual workflows, reducing errors, and empowering teams to focus on more strategic tasks. Moreover, Business Intelligence plays a crucial role in transforming raw data into actionable insights, enabling informed decision-making that drives growth and innovation.

The BPM market, valued at 3.38 billion in 2020, is projected to grow to 4.78 billion by 2026, particularly in the insurance BPM sector, driven by the BFSI industry, underscoring the relevance of BPM in today’s market. To overcome these hurdles, it is vital to:

- Engage stakeholders early in the BPM initiative.

- Clearly communicate the benefits of BPM and RPA.

- Provide comprehensive training and support.

Approaches like encouraging an open conversation regarding the changes, tackling employee issues directly, and obtaining executive support are essential, as they promote a cultural shift that positions BPM as a strategic priority instead of just a simple adjustment.

By proactively tackling these challenges, providers can foster an atmosphere favorable to successful BPM implementation, ultimately improving their efficiency and customer service. For instance, Aviva Insurance, which serves 33 million customers, achieved remarkable results through insurance BPM implementation, realizing customer service improvements that were nine times faster. This case exemplifies the transformative potential of BPM, RPA, and AI when effectively managed.

Tailored AI solutions can further enhance BPM efforts by addressing specific business challenges, ensuring that organizations are well-equipped to navigate the complexities of the modern landscape.

Future Trends in BPM for the Insurance Industry

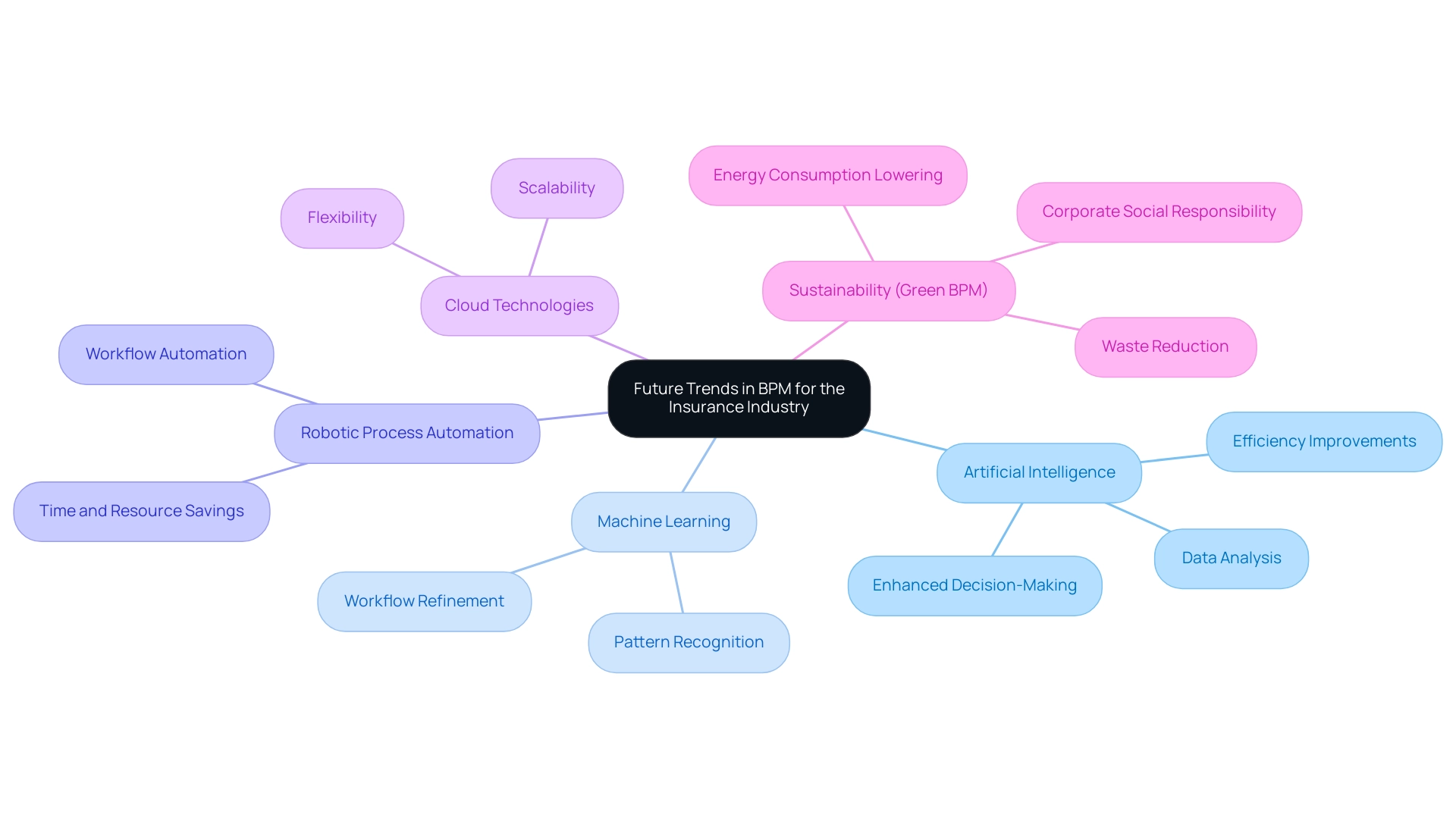

The evolution of Business Process Management (BPM) within the insurance sector is on the brink of a significant transformation, driven by cutting-edge technological advancements in insurance BPM. Key trends, including artificial intelligence (AI), machine learning, and advanced analytics, are set to revolutionize BPM capabilities. Manual, repetitive tasks can significantly slow down operations, leading to wasted time and resources.

However, utilizing Robotic Process Automation (RPA) can automate these workflows, significantly improving efficiency in a rapidly evolving AI landscape. AI plays a crucial role in enhancing decision-making processes by effectively analyzing extensive datasets to uncover patterns and forecast outcomes. Meanwhile, machine learning continuously refines workflows by learning from functional data, leading to increased efficiency.

Furthermore, the integration of BPM with cloud technologies promises heightened flexibility and scalability, empowering insurance firms to swiftly adapt to shifting market dynamics in insurance BPM. A significant instance of this is the case analysis on Green BPM, which incorporates sustainability into business activities, encouraging eco-friendly practices while preserving efficiency. This approach not only reduces waste and energy consumption but also enhances corporate social responsibility profiles, making it a standard business practice in the industry.

By embracing these innovations, insurers position themselves for competitive advantage and enhance their insurance BPM to better respond to evolving customer expectations in a rapidly digitizing landscape. As Christopher Groenne, a product strategy consultant, aptly noted,

In 2025, workflow discovery will be pivotal in uncovering inefficiencies and continuously optimizing workflows.

This innovative strategy highlights the necessity for leaders in the field to utilize advanced process mining tools, customized AI solutions, and RPA technologies within insurance BPM, promoting data-driven decisions that improve efficiency and customer satisfaction.

Moreover, generative AI encourages innovation by stimulating creativity and generating new ideas, especially when traditional thinking has plateaued, further emphasizing the importance of these technological advancements in shaping the future of BPM in the insurance BPM sector. For more insights, refer to our latest publication on enhancing operational efficiency through RPA and AI solutions.

Conclusion

The integration of Business Process Management (BPM) in the insurance sector is not merely a trend; it represents a strategic shift towards enhanced operational efficiency and compliance. By systematically analyzing and optimizing processes like policy issuance and claims management, insurance companies can significantly reduce redundancies and errors, ultimately leading to improved customer satisfaction. The rise of low-code solutions and RPA technologies empowers organizations to automate repetitive tasks, allowing employees to focus on more strategic initiatives that add value to the business.

Challenges such as employee resistance and the need for executive buy-in can complicate BPM implementation. However, by fostering a culture of openness and providing robust training, organizations can overcome these hurdles. Engaging stakeholders early in the process and clearly communicating the benefits of BPM can facilitate a smoother transition and enhance the overall effectiveness of the initiative.

Looking to the future, the convergence of AI, machine learning, and advanced analytics will further transform BPM capabilities in the insurance industry. This evolution not only promises to streamline operations but also enables insurers to respond swiftly to changing market dynamics and customer expectations. By embracing these technological advancements, organizations can position themselves for sustainable growth and operational excellence, ensuring they remain competitive in an ever-evolving landscape.