Introduction

In an increasingly digital landscape, organizations are recognizing the critical need to streamline their invoice processing to enhance operational efficiency and reduce costs. Automated invoice processing stands out as a transformative solution, leveraging advanced technologies like Robotic Process Automation (RPA) and Artificial Intelligence (AI) to eliminate manual errors and accelerate workflows.

Despite the clear advantages, many companies remain hesitant to adopt these innovations, often due to misconceptions about complexity and cost. This article delves into the essential components of automated invoice processing, highlighting its benefits, implementation strategies, and the tools necessary for success.

By addressing common challenges and providing practical solutions, organizations can unlock the full potential of automation, paving the way for improved cash flow management, compliance, and overall productivity. As businesses prepare for a future where efficiency is paramount, understanding and embracing automation becomes not just beneficial, but imperative.

Understanding Automated Invoice Processing

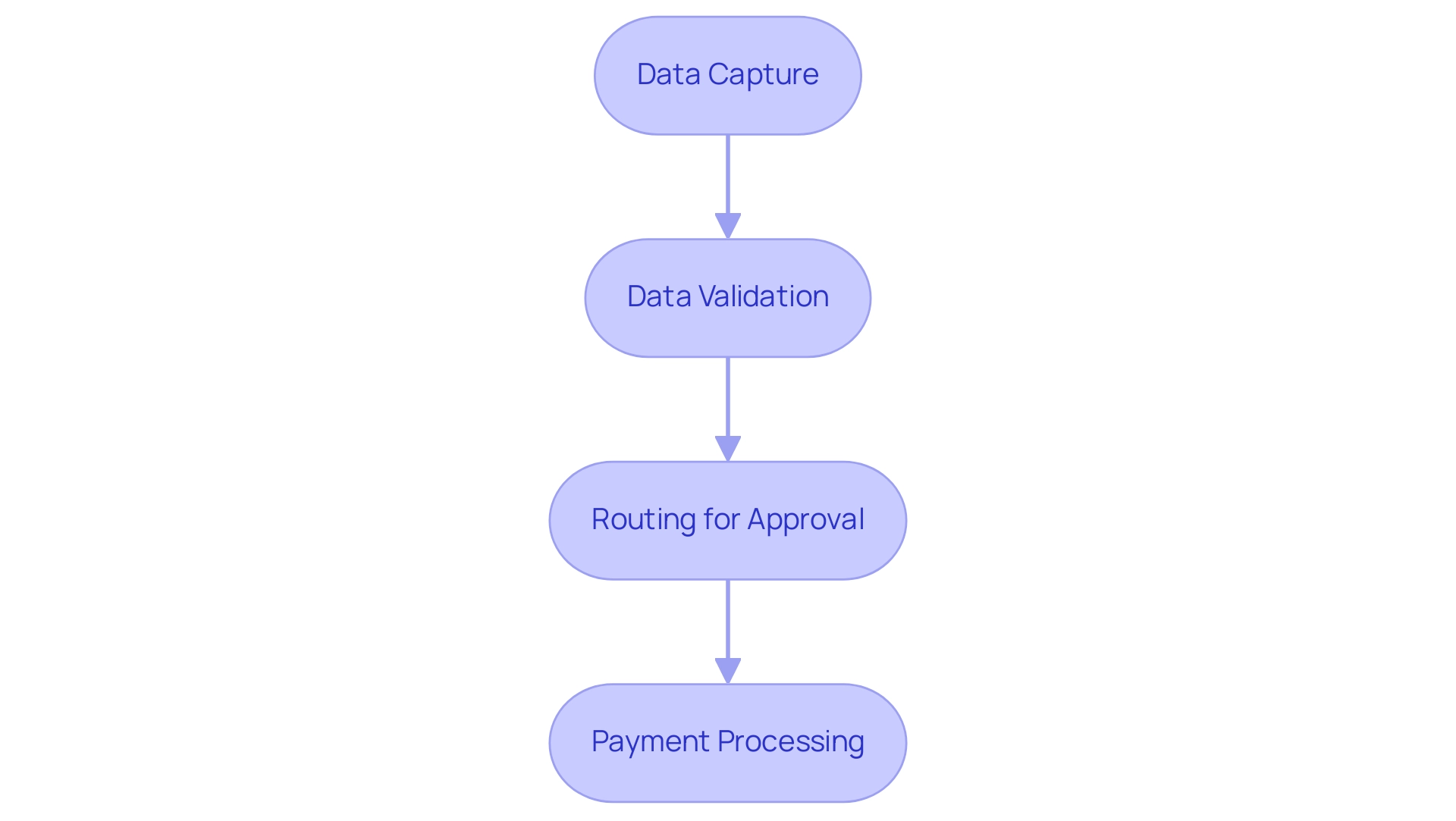

Automating invoice processing harnesses advanced technology to effectively manage and streamline the entire billing lifecycle, from receipt to payment. This innovative method includes the capture of billing data, validation against purchase orders, and routing for approval—all accomplished without manual intervention. By implementing robotic process technology (RPA) and artificial intelligence (AI), organizations can significantly improve accuracy, speed, and efficiency in automating invoice processing.

However, it’s noteworthy that fewer than 20% of firms have fully automated invoice processing, indicating substantial room for growth in this critical area of automating invoice processing. As of 2022, India took the lead in streamlining processes by generating over 1.5 billion e-invoices, illustrating the global shift towards efficiency. Companies like IKEA are also recognizing the environmental benefits; in 2021, they reported saving approximately 5,000 trees annually by transitioning to e-invoicing.

Furthermore, Stampli has emerged as a leader in accounts payable (AP) automation, offering user-friendly integration and a no-code implementation process, making it a valuable tool for entities aiming to enhance their AP processes. Grasping the subtleties of automated billing management is crucial for any organization aiming to enhance operational efficiency and reduce risks related to manual handling—particularly as payment fraud increased by 47% in 2020. It’s crucial to address the common perceptions that AI projects are time-intensive and costly, as well as the importance of improving poor master data quality, which is foundational for successful AI integration.

As we move into 2024, the ongoing development of RPA and AI will further transform financial document management, emphasizing the need for businesses to remain informed and flexible.

Key Benefits of Automating Invoice Processing

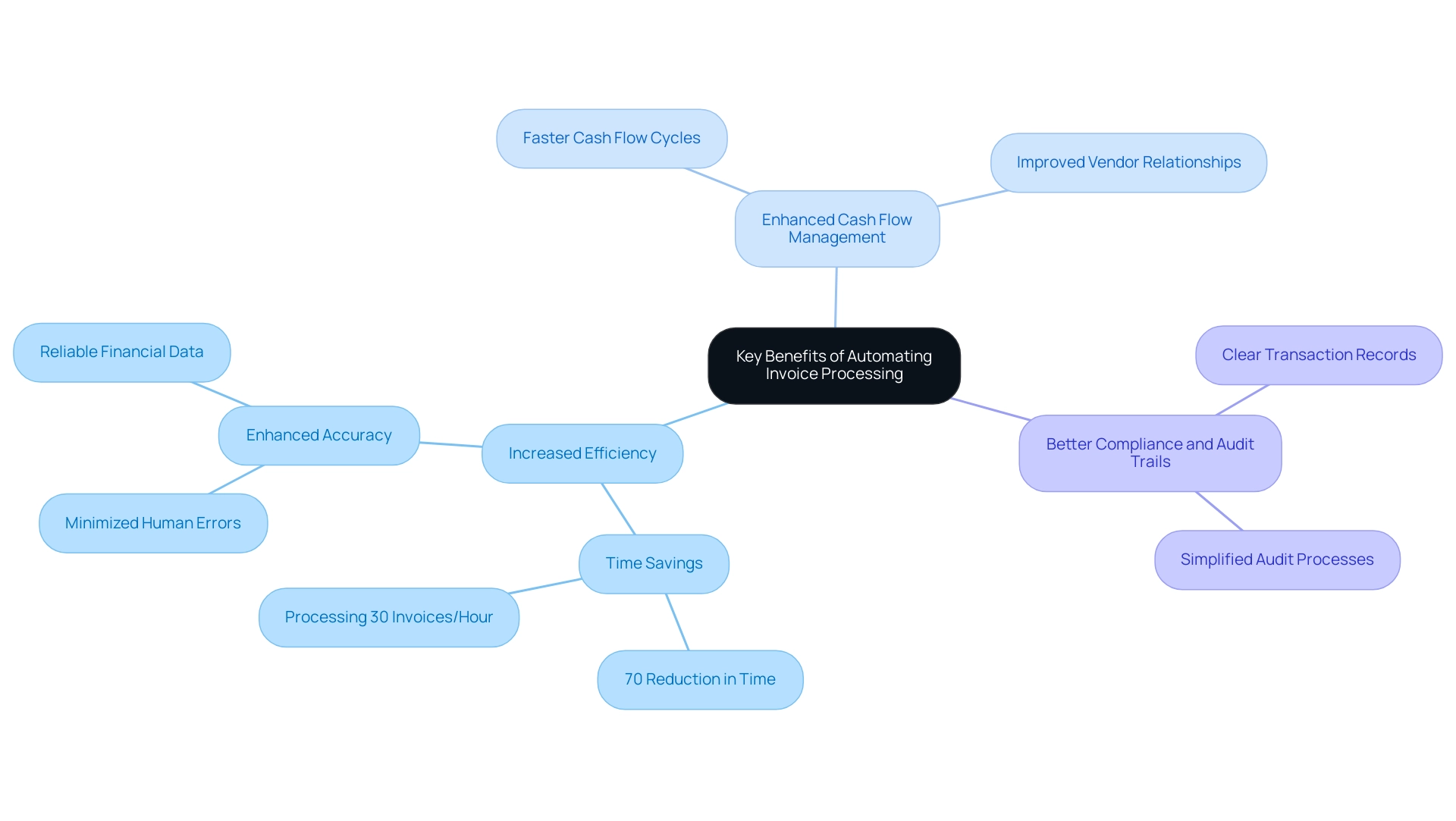

The practice of automating invoice processing presents a multitude of compelling benefits that can significantly enhance operational efficiency, especially in the context of South Africa, which is responsible for 63.9% of late payments—an alarming increase from 15.3% the previous year. By leveraging Robotic Process Automation (RPA), entities can explore key advantages:

-

Increased Efficiency: Automating invoice processing drastically reduces the time dedicated to manual data input and handling. This shift empowers teams to concentrate on high-value tasks, ultimately boosting overall productivity. For instance, automating invoice processing can save entities more than 70% of the time spent on accounts payable, allowing finance teams to process up to thirty invoices per hour compared to just five manually. Enhanced accuracy is achieved through automating invoice processing, which minimizes human intervention and leads to a substantial reduction in errors typically associated with manual processing. This increased accuracy not only enhances the reliability of financial data but also builds trust in the entity’s financial operations. Cost savings from automating invoice processing result from streamlined workflows that lower operational costs by reducing labor expenses and improving invoice cycle times. With an increase in processing speed, companies can realize significant savings. Research indicates that mechanization can significantly enhance productivity, emphasizing the necessity for companies to update their workflows in a swiftly changing AI environment.

-

Enhanced Cash Flow Management: The mechanization of billing approvals and payments speeds up cash flow cycles and bolsters supplier relationships. Swift processing ensures timely payments, which enhances the entity’s credibility and reliability among vendors.

-

Better Compliance and Audit Trails: Automated systems create clear, accessible records of all transactions, facilitating compliance and simplifying audit processes. This openness is vital for fulfilling regulatory obligations and upholding institutional integrity.

Recognizing these advantages enables entities to make educated choices regarding the implementation of automating invoice processing. As Shaun Jex, a Financial Automation Content Specialist, aptly observes,

Though the drawbacks of these outdated AP methods are well known, paper checks still account for 40% of transactions — leaving plenty of opportunity for companies to modernize their workflows. Embracing mechanization is no longer just an option; it is a necessary move towards operational excellence in 2024.

Furthermore, by unlocking the power of Business Intelligence, organizations can transform raw data into actionable insights, enabling informed decision-making that drives growth and innovation while cutting through the noise of the evolving AI landscape.

Step-by-Step Guide to Implementing Invoice Automation

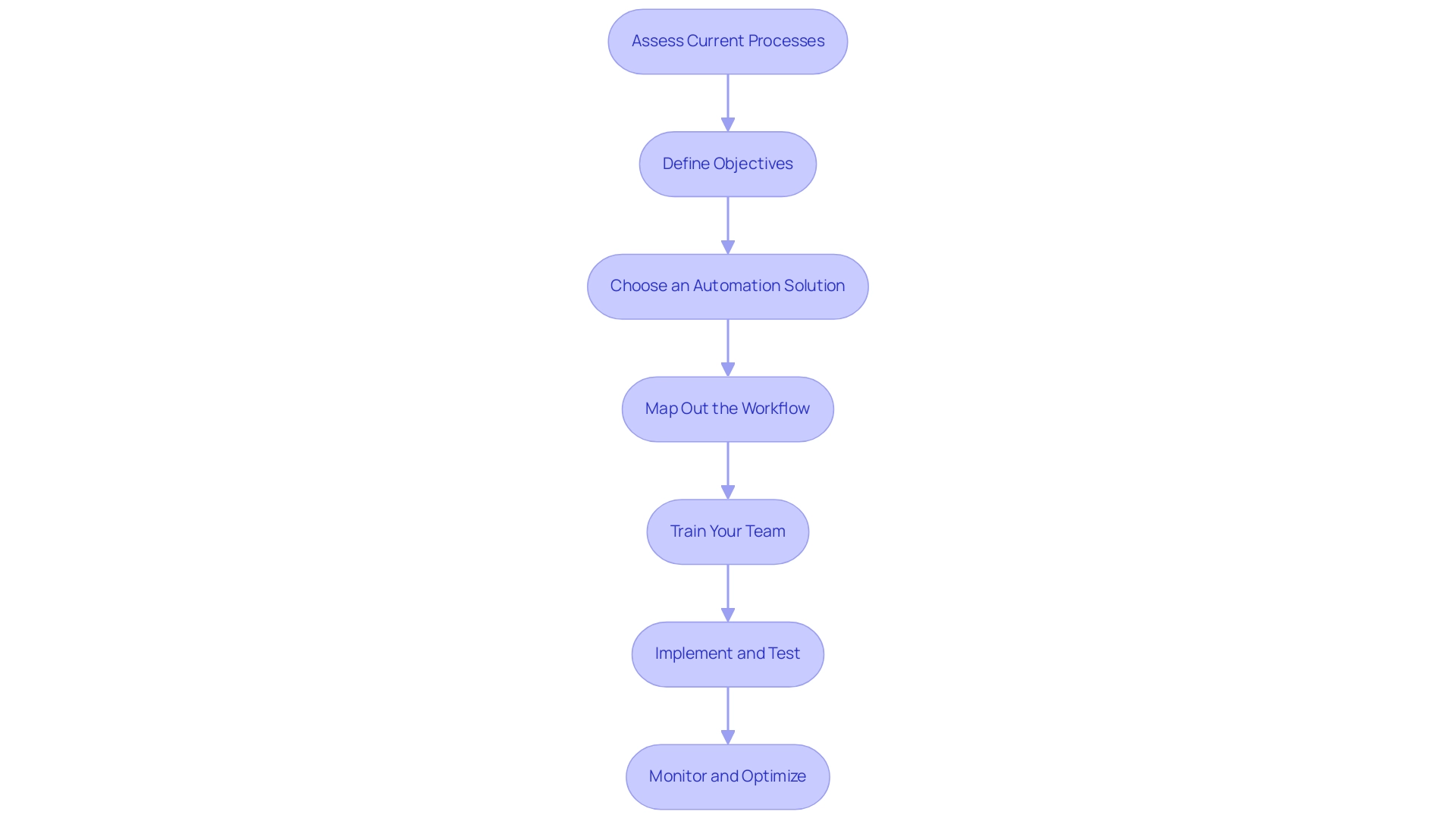

Implementing automated billing management is a strategic decision that can greatly improve operational efficiency, especially as we move toward a future where over 100 million workers may need to switch careers due to reasons like remote work and mechanization by 2030. Follow these empowering steps to ensure a successful transition:

-

Assess Current Processes: Begin by analyzing your existing invoice processing workflow. Identify bottlenecks that impede efficiency and areas ripe for improvement, particularly in repetitive tasks that drain morale and productivity. A thorough evaluation establishes the foundation for automating invoice processing efficiently.

-

Define Objectives: Establish clear, measurable goals for your automated initiative. Consider objectives such as reducing processing time, enhancing accuracy, or increasing overall throughput. Clearly outlined objectives will direct your strategy, ensuring alignment with your operational efficiency targets by automating invoice processing.

-

Choose an Automation Solution: Research and select a suitable Robotic Process Automation (RPA) or Artificial Intelligence (AI) solution that aligns with your business needs. Be sure to consider solutions that can seamlessly integrate with your existing systems, addressing the challenges posed by outdated technologies.

-

Map Out the Workflow: Create a detailed workflow diagram that illustrates the process of automating invoice processing, from receipt to payment. This visual representation assists all stakeholders in comprehending the new process and recognizing any potential challenges, ensuring transparency in how mechanization will alleviate staffing shortages.

-

Train Your Team: Empower your staff with comprehensive training and resources on the new system. Ensuring that your team is well-versed in the updated processes is crucial to overcoming resistance and fostering a culture of efficiency, especially in a time when talent retention is critical.

-

Implement and Test: Roll out the automated solution in stages to minimize disruption. Testing each part of the process before full implementation helps to identify issues early on, ensuring that the system works as intended, thus mitigating risks associated with process changes.

-

Monitor and Optimize: After implementation, continuously oversee the performance of the automated system. Gather feedback and data to identify areas for further optimization. Regular adjustments will enhance efficiency and adapt to evolving business needs, demonstrating the ROI benefits of your initiative.

By following these steps, businesses can effectively transition to automating invoice processing, driving productivity and reducing the risk of being a bottleneck in operations. Crucially, our risk-free ROI guarantee ensures that you only pay if the system is delivered as planned. As noted by Kellie Parks from Calmwaters Cloud Accounting, “I realized that I would not be able to grow that way because I would be the bottleneck of the business.”

Embracing technology is essential for fostering growth and efficiency in today’s rapidly evolving work environment. Additionally, a study found that 55.2% of firms report that automation has made their onboarding processes smoother, and specific case studies show that GUI automation can reduce data entry errors by 70% and accelerate testing processes by 50%, highlighting the broader benefits of automation across different functions.

Essential Tools and Technologies for Invoice Automation

To effectively automate billing management in healthcare and financial sectors, organizations should leverage a range of advanced tools and technologies that enhance efficiency and accuracy while fostering collaboration to address conflicting account plans:

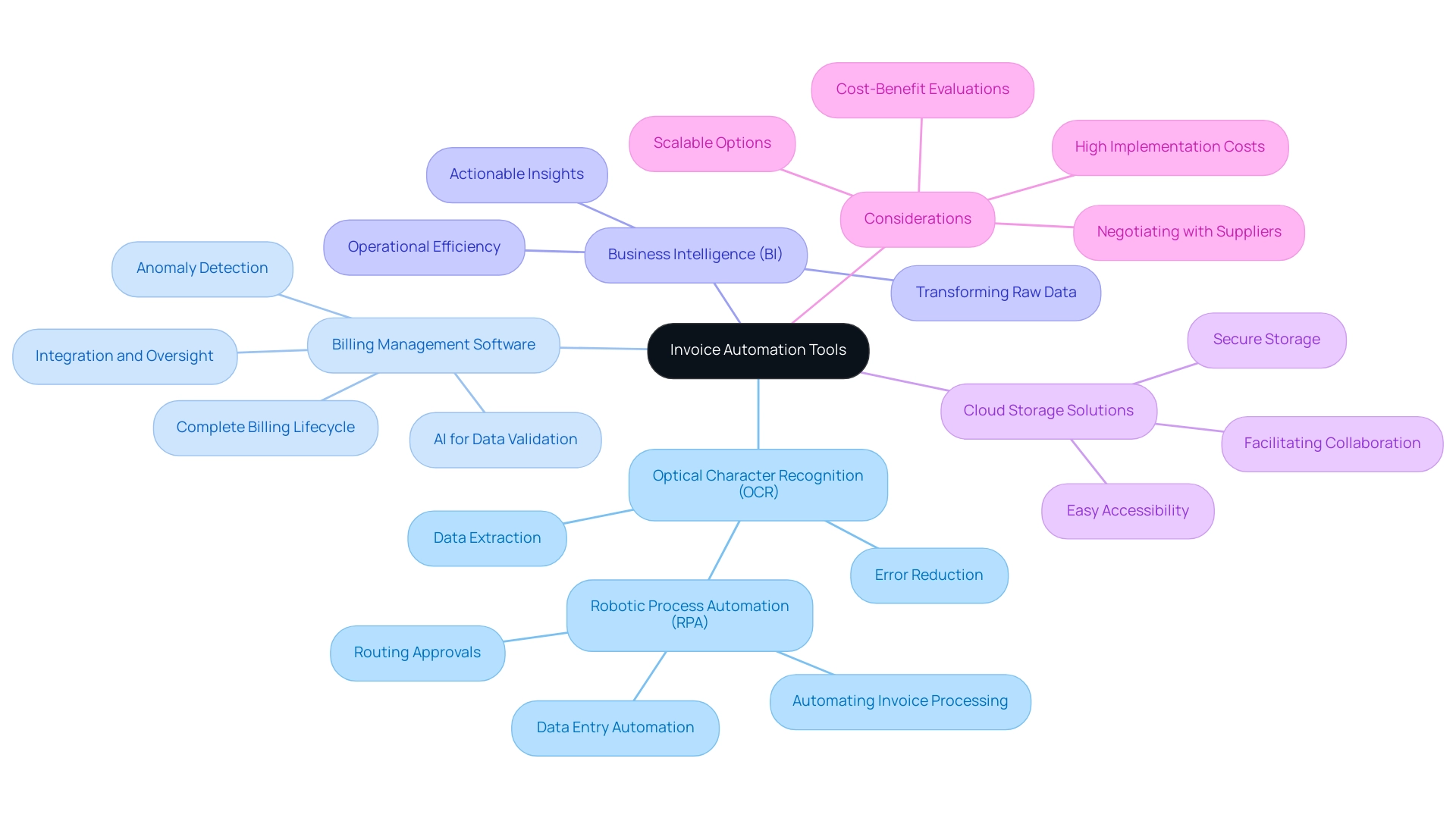

- Optical Character Recognition (OCR): This transformative technology efficiently captures and extracts data from paper bills, converting them into a digital format that streamlines processing and minimizes manual entry errors.

- Robotic Process Automation (RPA) technologies excel in automating invoice processing as well as other repetitive tasks such as data entry, bill validation, and routing approvals.

-

By automating invoice processing, companies can free up valuable human resources for more strategic initiatives, ultimately enhancing productivity in a rapidly evolving AI landscape.

-

Billing Management Software: Comprehensive solutions like Coupa and SAP Concur provide platforms that handle the complete billing lifecycle, from receipt to payment, ensuring seamless integration and oversight.

- This enables entities to maintain effective communication and collaboration throughout the process.

- Artificial Intelligence (AI) significantly enhances data validation processes and anomaly detection, which is crucial for automating invoice processing and reducing the risk of errors.

-

Tailored AI solutions provide insights that support informed decision-making, driving growth and innovation.

-

Business Intelligence (BI): In today’s data-rich environment, leveraging BI is crucial for transforming raw data into actionable insights.

-

This capability allows entities to make informed decisions that enhance operational efficiency and competitive advantage.

-

Cloud Storage Solutions: Utilizing cloud-based systems guarantees secure storage and easy accessibility of billing data, facilitating collaboration and ensuring that critical information is always within reach.

However, entities must also consider the high implementation costs associated with these technologies, which can be a significant barrier for small and medium-sized enterprises in the billing and invoicing software market. To handle unforeseen costs, businesses can implement strategies like performing comprehensive cost-benefit evaluations, seeking scalable options, and negotiating with suppliers to improve their billing management efforts.

Choosing the best mix of these tools is crucial for a successful project, allowing entities to streamline operations, lower expenses, and boost overall efficiency while ensuring effective communication and collaboration.

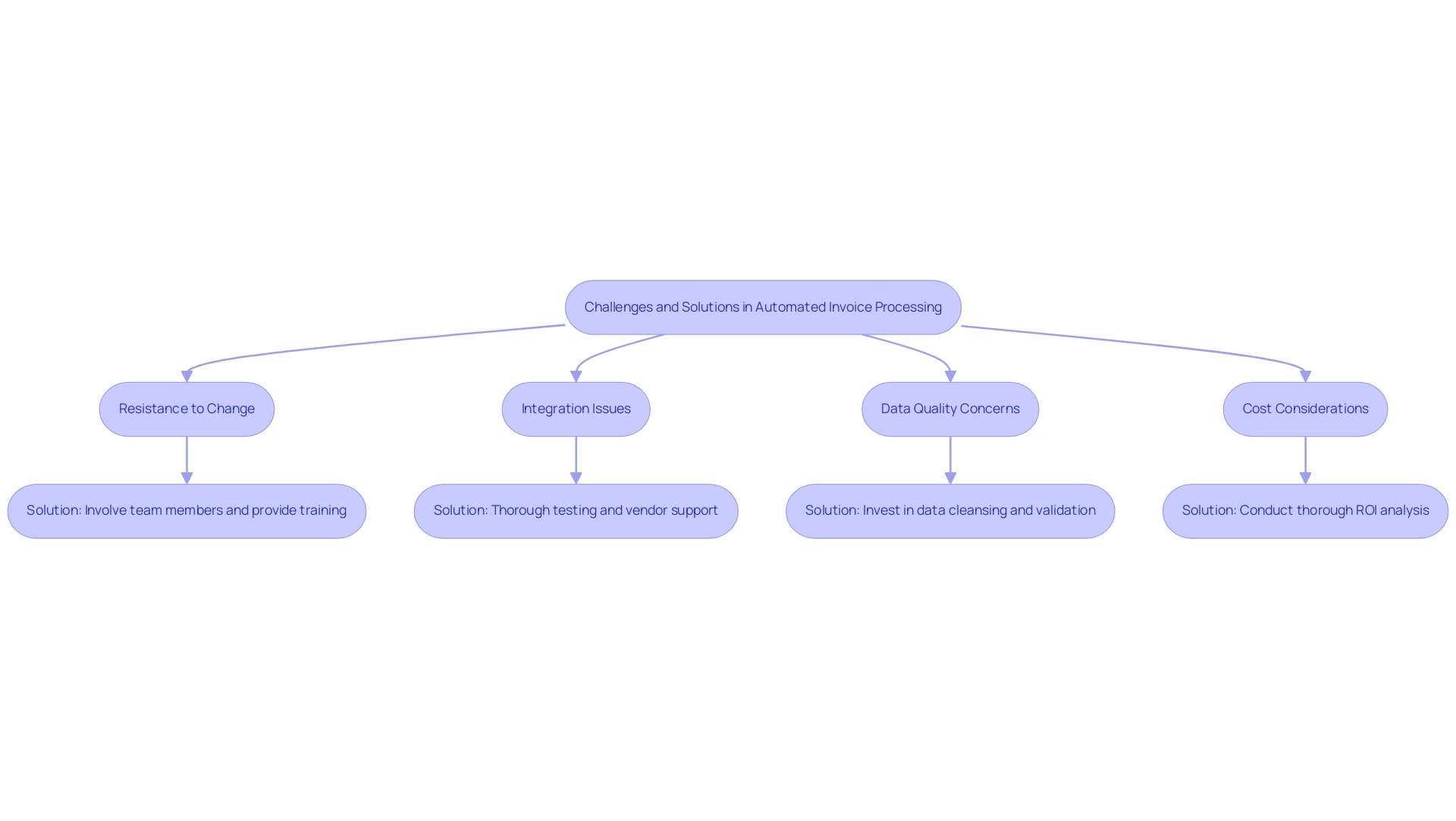

Overcoming Challenges in Automated Invoice Processing

Implementing automating invoice processing can yield significant operational benefits, yet organizations often face several key challenges.

-

Resistance to Change: Employee resistance in adopting new technologies is a common barrier. To effectively counter this, involve team members in the mechanization process from the outset and provide robust training programs to enhance their comfort with the new systems.

Engaging employees helps foster a sense of ownership and reduces resistance. -

Integration Issues: Achieving seamless incorporation of automated solutions with existing systems can be intricate. Similar to the experience of a mid-sized healthcare company that faced manual data entry errors and slow software testing, organizations should prioritize thorough testing prior to deployment and actively seek support from vendors.

This proactive approach minimizes disruptions and ensures a smoother transition. -

Data Quality Concerns: Automation is only as effective as the data it processes. Inaccurate or incomplete data can significantly hinder efforts to automate.

Therefore, it is essential to invest in data cleansing and validation processes before implementation to ensure high-quality inputs for automated systems, as observed in successful implementations that led to a 70% reduction in data entry errors. -

Cost Considerations: Initial setup costs can pose a barrier to adoption. To tackle this, organizations should perform a thorough ROI analysis that clearly illustrates the long-term savings and efficiency improvements linked to automated processes.

For instance, the mid-sized company achieved ROI within 6 months after implementing GUI mechanization, providing a compelling case for stakeholders.

The relevance of mechanization in operational processes is underscored by the forecasted growth of the cloud mechanization market by $103.9 billion, emphasizing the increasing importance of adopting automated solutions. Moreover, the Industrial Automation Services Market is anticipated to grow from $147.06 billion in 2019 to $264.69 billion by 2026, emphasizing wider trends that influence billing management. Furthermore, the anticipated rise of the automated farming equipment market to $23.06 billion by 2028 illustrates the growing demand for automation across various sectors, reinforcing the need for organizations in finance and healthcare to embrace solutions like automating invoice processing.

By anticipating these challenges and implementing targeted strategies to address them, including conducting a thorough ROI analysis, organizations can significantly enhance their likelihood of a successful automation initiative, thus improving overall operational efficiency.

Conclusion

Embracing automated invoice processing is not simply a trend; it represents a critical evolution for organizations striving for operational excellence in a fast-paced digital environment. The article outlines how leveraging technologies like RPA and AI can significantly enhance efficiency, accuracy, and cost-effectiveness in invoice management. By automating key processes, organizations can reduce manual errors, accelerate workflows, and ultimately improve cash flow management, all while fostering better compliance and audit trails.

Implementing such automation requires a clear strategy, beginning with an assessment of current processes and setting measurable objectives. The step-by-step guide provided highlights the importance of choosing the right tools, training teams, and continuously monitoring performance to ensure that the transition is smooth and effective. Overcoming challenges like resistance to change and integration issues is essential, as these barriers can hinder the potential benefits of automation.

In conclusion, the shift towards automated invoice processing is imperative for organizations looking to thrive in an increasingly competitive landscape. By addressing common misconceptions and embracing the necessary tools and strategies, businesses can unlock substantial operational improvements. As the future unfolds, those who prioritize automation will position themselves for success, enhancing not only their efficiency but also their ability to adapt to evolving market demands. The time to act is now; automation is not just advantageous but essential for sustainable growth and efficiency in the years to come.