Introduction

Navigating the complexities of the insurance industry can be a daunting task, particularly when it comes to managing claims efficiently. As organizations strive to enhance their operational processes, insurance claim automation emerges as a transformative solution. By harnessing advanced technologies such as Robotic Process Automation (RPA) and artificial intelligence, companies can streamline their claims processes, reducing processing time and minimizing errors.

However, the journey toward automation is not without its challenges, including employee resistance and the need for robust data management. This article delves into the multifaceted world of insurance claim automation, exploring its benefits, challenges, and the technological foundations that support this evolution.

By understanding these dynamics, organizations can position themselves for success in an increasingly competitive landscape, ensuring they not only meet but exceed customer expectations.

Understanding Insurance Claim Automation: An Overview

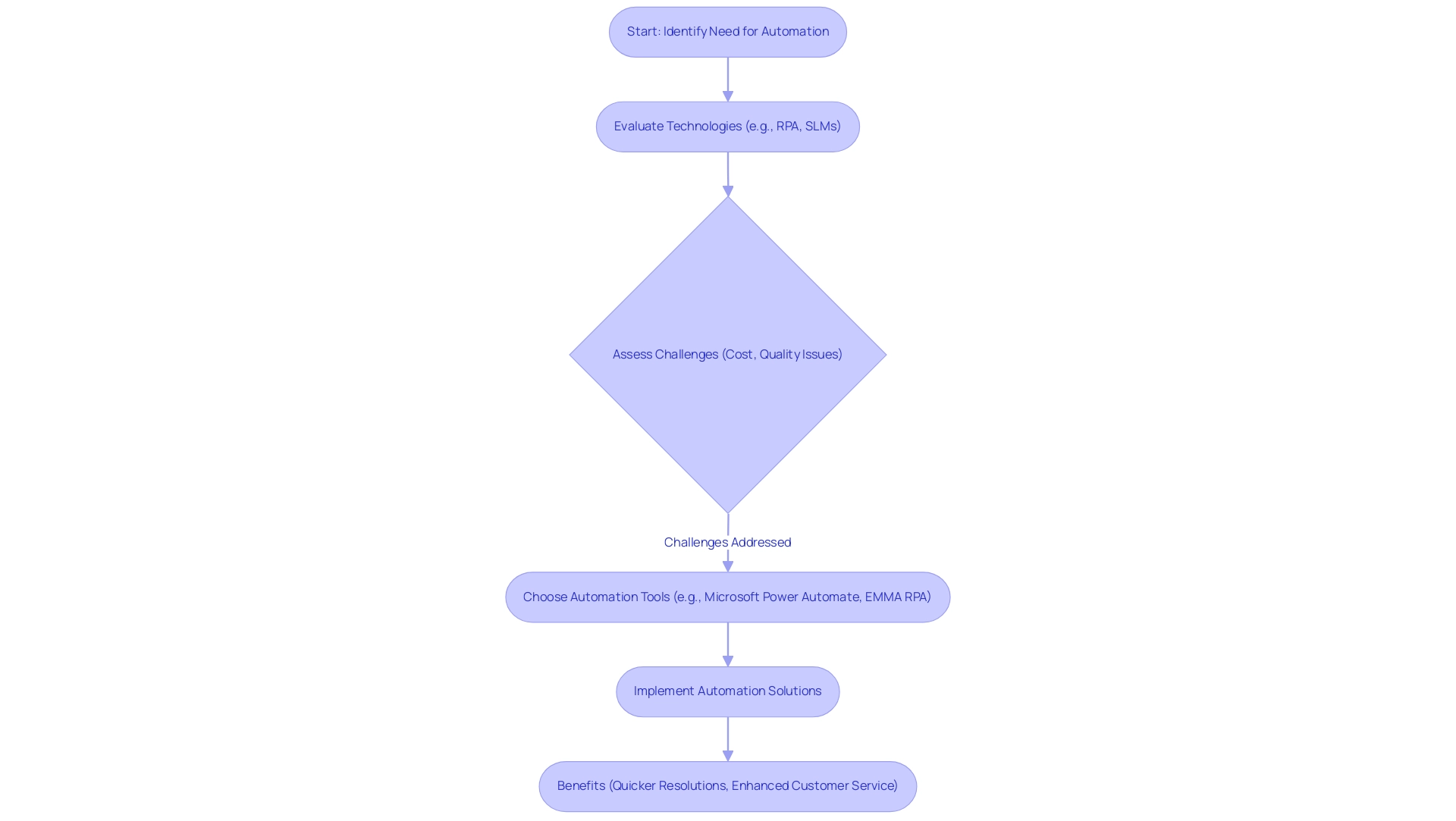

Insurance claim automation pertains to the use of technology to simplify and oversee the submissions in the insurance sector. This entails utilizing software and systems that automatically manage various tasks, such as information entry, assessment of requests, and interaction with policyholders. By automating these procedures with insurance claim automation through innovative solutions such as Robotic Process Automation (RPA) and Small Language Models (SLMs), insurance firms can significantly decrease the time and effort needed to handle requests, resulting in quicker resolutions and enhanced customer service.

However, many organizations hesitate to adopt AI due to perceived costs and complexities, as well as challenges related to poor master information quality. Addressing these issues is essential for successful implementation. For instance, Microsoft Power Automate can enhance efficiency and accuracy while creating a risk-free ROI assessment.

Additionally, tools like EMMA RPA specifically address task repetition fatigue and staffing shortages, further transforming operations for better productivity and employee morale. Real-world examples of companies that have successfully implemented SLMs and RPA solutions can provide valuable insights into the tangible benefits of these technologies.

Key Benefits of Automating Insurance Claims

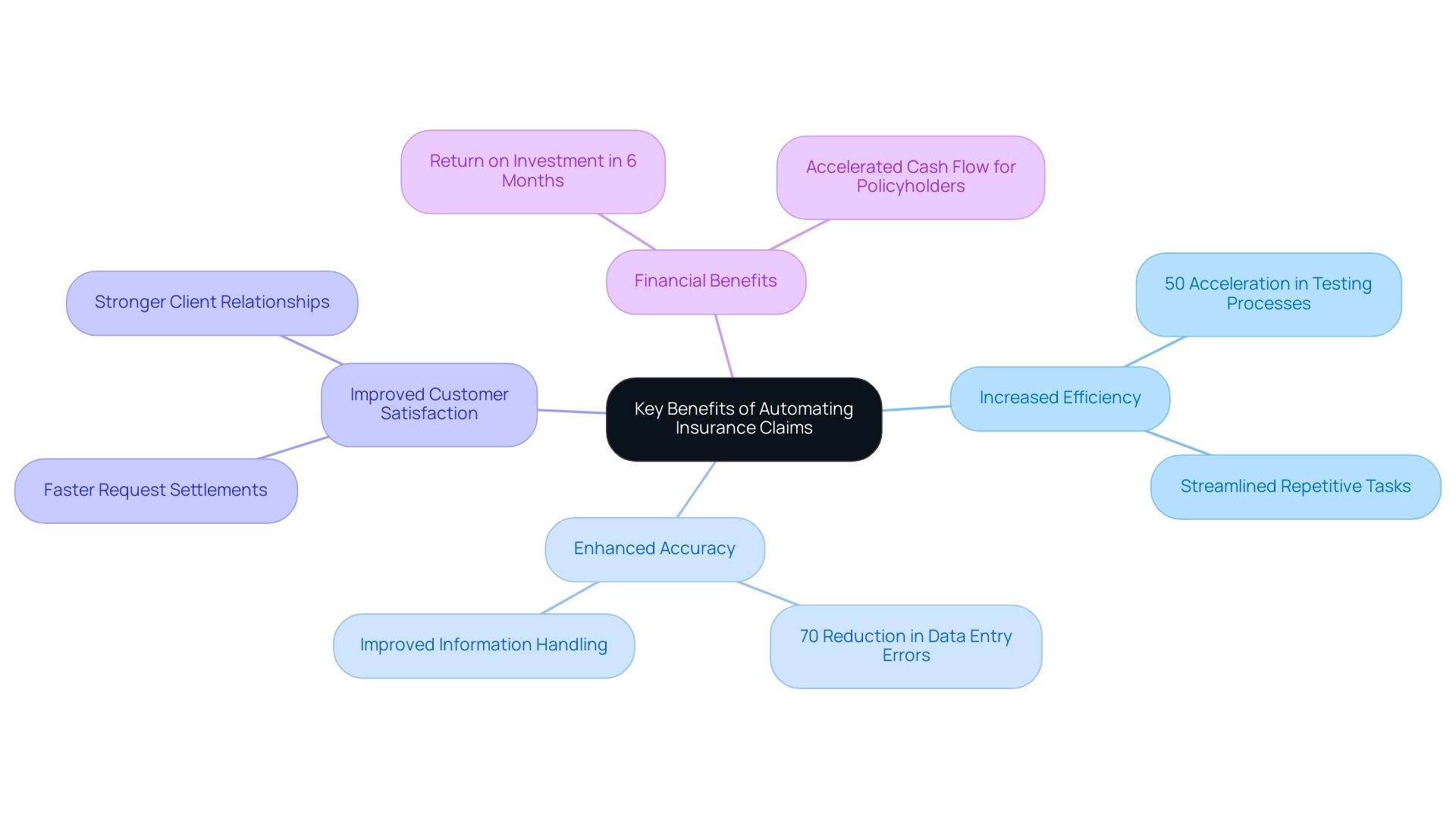

The mechanization of insurance claim automation is transforming operational methods, yielding significant advantages such as increased efficiency, enhanced accuracy, and improved customer satisfaction. A compelling example is a mid-sized company that enhanced efficiency by mechanizing information input, software testing, and legacy system integration using GUI mechanization. This transformation addressed challenges such as manual data entry errors and slow software testing, achieving a remarkable 70% reduction in data entry errors and a 50% acceleration in testing processes.

Furthermore, the implementation of GUI features enabled the seamless integration of outdated systems, which had previously posed significant hurdles. Significantly, the company achieved a return on investment (ROI) within only 6 months, highlighting the financial benefits of the automated solution. In the same way, a UK-based non-profit organization collaborated with FirstSource to eradicate a remarkable 30-month backlog of requests, demonstrating how mechanization can fundamentally alter operational timelines.

By streamlining repetitive tasks, insurance claim automation allows insurance companies to drastically reduce the average time taken to settle requests, thereby accelerating cash flow for policyholders and minimizing human errors associated with manual processing. Moreover, mechanization improves information handling and analytical abilities, enabling insurers to obtain insights into trends in requests and customer behavior. This strategic approach enables companies to refine their service offerings and cultivate stronger relationships with clients, ultimately leading to higher retention rates and enhanced customer loyalty.

Challenges in Implementing Insurance Claim Automation

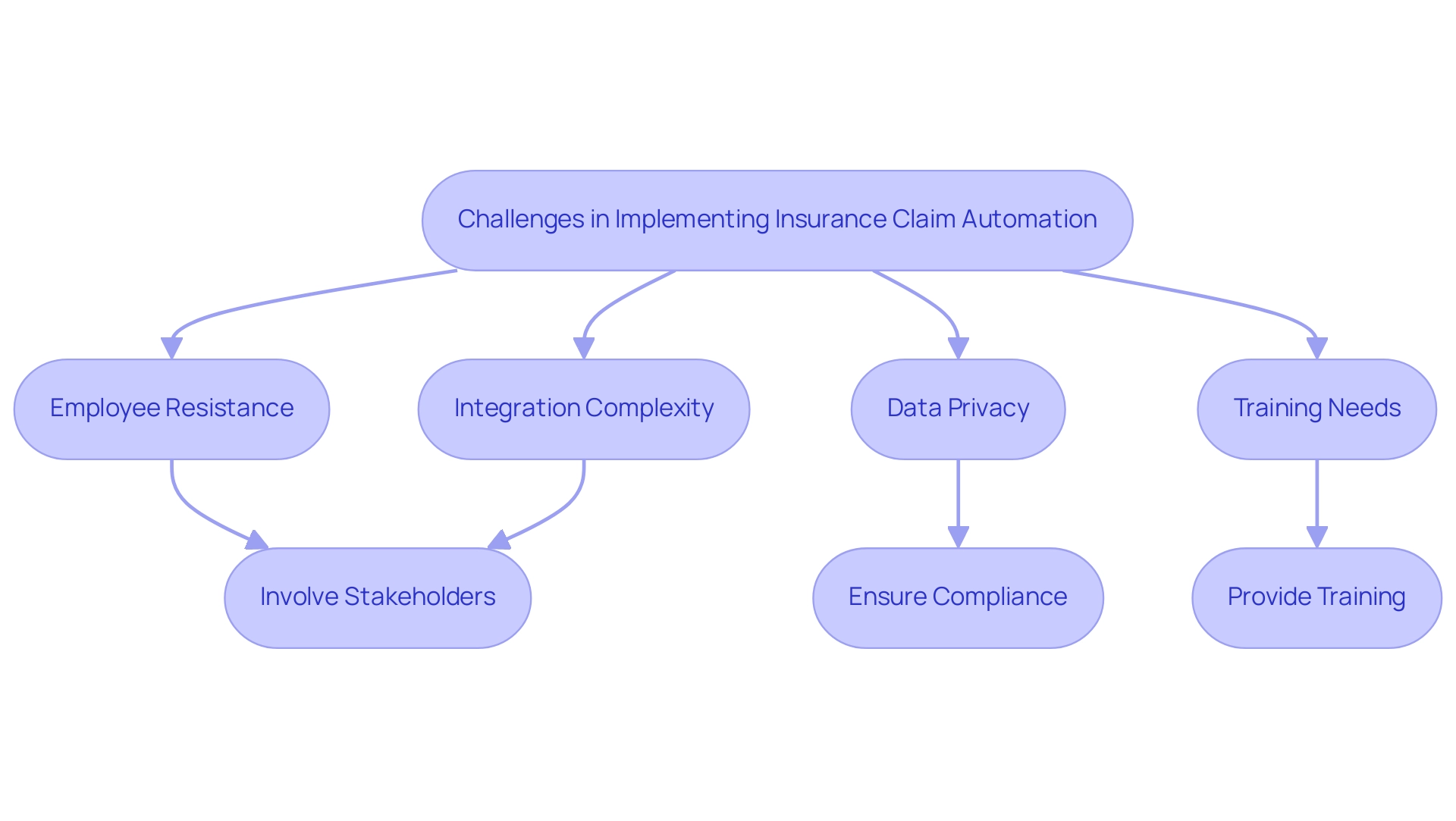

Implementing insurance claim automation comes with several challenges that organizations must navigate. Resistance from employees fearing job displacement is common, highlighting the need for effective change management strategies. Additionally, integrating new technologies with existing systems can be complex and may require significant investment in training and resources.

It is essential to leverage tailored AI solutions and engage in hands-on training through GenAI workshops to equip your team with the necessary skills. Moreover, data privacy and security continue to be essential issues, as safeguarding sensitive customer information during automated procedures is vital. To overcome these challenges, organizations should:

1. Involve stakeholders early in the transition process

2. Provide adequate training

3. Ensure compliance with regulatory requirements

By proactively addressing these issues and utilizing Robotic Process Automation (RPA) to enhance operational efficiency and drive productivity, companies can facilitate a smoother transition to insurance claim automation. RPA not only streamlines workflows but also contributes to increased productivity and lower operational costs. Furthermore, incorporating Business Intelligence can assist in informed decision-making, while ethical AI usage guarantees that the implementation of technology aligns with privacy regulations and ethical standards.

Technological Foundations of Insurance Claim Automation

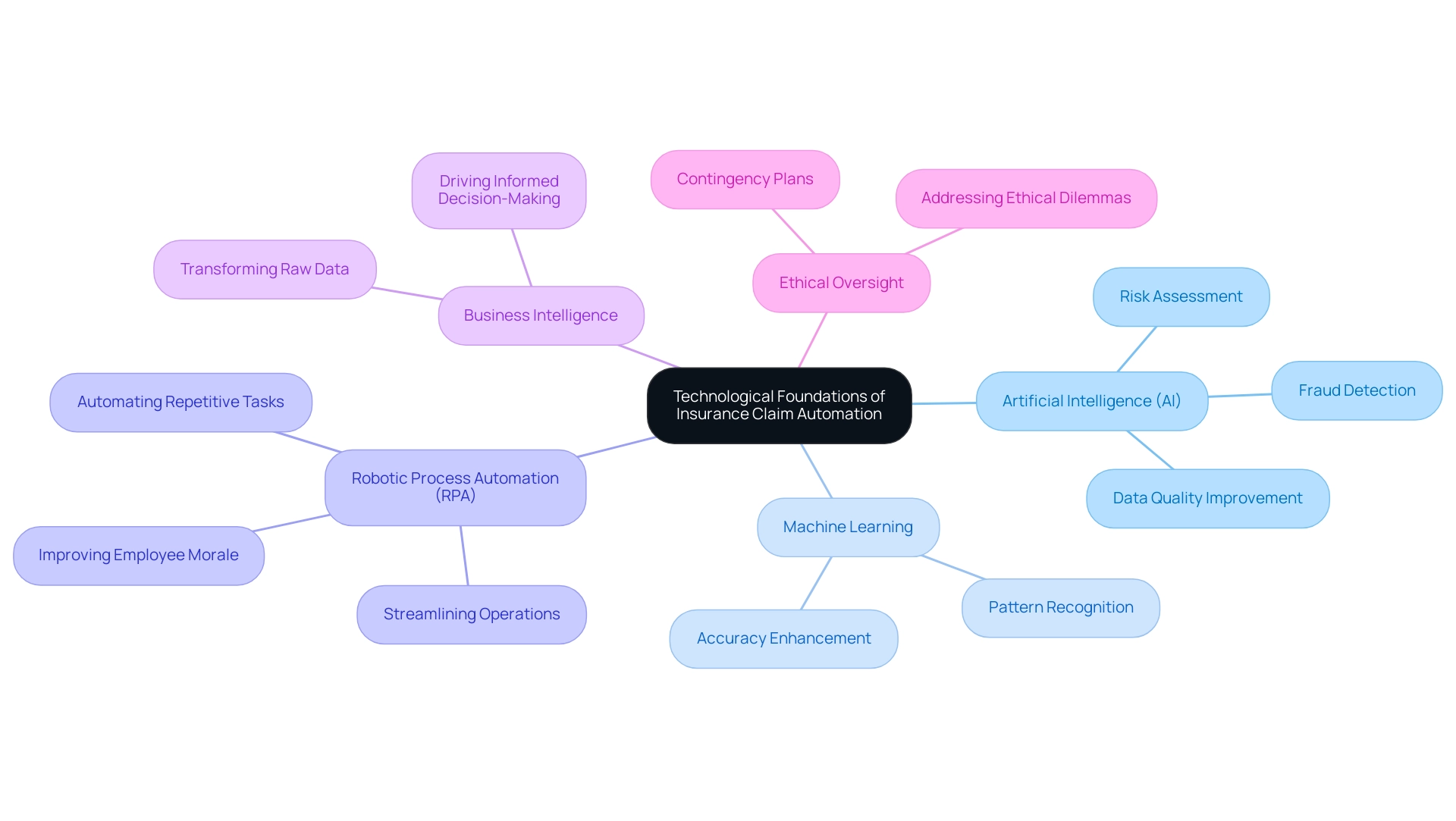

The foundation of insurance automation is established by advanced technologies such as artificial intelligence (AI), machine learning, and robotic automation (RPA). AI algorithms excel at analyzing claims information, identifying patterns and anomalies that are vital for fraud detection and risk assessment. Machine learning further refines this process, enhancing the accuracy of predictions by learning from past information.

Meanwhile, RPA, especially via innovative tools like EMMA RPA and Microsoft Power Automate, streamlines operations by automating repetitive tasks such as information entry and document processing. This allows human resources to concentrate on more complex decision-making, significantly boosting operational efficiency and accuracy while also improving employee morale by reducing the burden of mundane tasks. This trio of technologies creates a robust framework for insurance claim automation.

Business Intelligence plays a critical role in this framework, transforming raw information into actionable insights that drive informed decision-making. Given the rapid advancements in AI—growing at an almost exponential rate—it is imperative for industry leaders to stay informed about these developments. As emphasized by James Barrat, numerous top AI experts hold contingency plans because of worries regarding these rapid technological shifts, demonstrating the vital necessity for ethical oversight in technology.

This underscores the importance of leveraging tailored AI solutions and business intelligence to improve data quality and enhance decision-making within the insurance sector. Explore how our RPA solutions can transform your operations and elevate your team’s performance.

Future Trends in Insurance Claim Automation

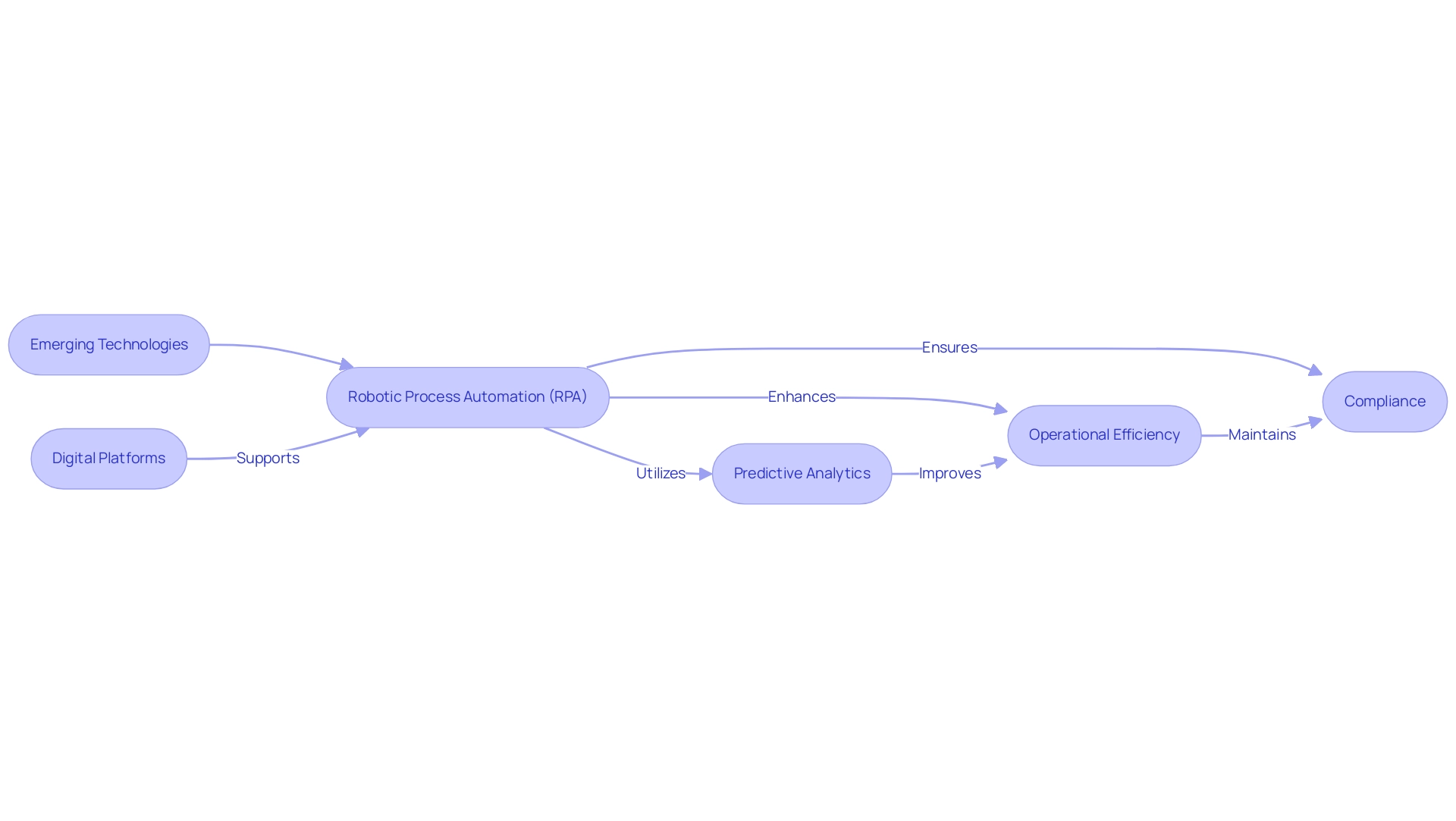

The future of insurance claim automation is poised for remarkable progress, propelled by emerging technologies and evolving consumer expectations. A key development is the integration of Robotic Process Automation (RPA) and tailored AI solutions, which enhance predictive analytics and enable more personalized customer experiences. Numerous organizations encounter difficulties with manual, repetitive tasks that can hinder the workflow, resulting in inefficiencies and mistakes.

By implementing RPA, these organizations can enhance operational efficiency through insurance claim automation, allowing them to automate routine tasks. Furthermore, the adoption of digital platforms and mobile applications will simplify the submission of requests through insurance claim automation, enabling policyholders to send their requests and monitor their status in real time. To meet the challenges posed by changing regulatory environments, automation must adapt to ensure compliance while maintaining operational efficiency.

For example, insurance claim automation can be implemented through automated workflows that automatically check for compliance with regulations at each step of the claims process. Organizations that proactively leverage RPA and Business Intelligence will be better positioned to drive data-driven insights and enhance their operational capabilities, meeting the demands of a rapidly evolving market.

Conclusion

Embracing insurance claim automation represents a pivotal shift in enhancing operational efficiency within the insurance industry. By leveraging advanced technologies such as Robotic Process Automation (RPA) and artificial intelligence, organizations can streamline their claims processes, resulting in faster resolutions and improved customer satisfaction. The significant benefits, including:

- Reduced processing times

- Enhanced accuracy

- The ability to manage data more effectively

underscore the transformative potential of automation.

However, the path to successful implementation is not without its challenges. Addressing:

- Employee resistance

- Ensuring robust data management

- Integrating new technologies with existing systems

are crucial steps that organizations must navigate. By focusing on effective change management and providing adequate training, companies can facilitate a smoother transition, ultimately leading to a more productive and engaged workforce.

Looking ahead, the future of insurance claim automation is bright, with emerging technologies poised to drive further innovations and improvements. As organizations adapt to evolving consumer expectations and regulatory requirements, the integration of digital platforms and advanced analytics will enhance the claims experience for policyholders. By proactively investing in automation solutions, insurance companies can not only meet but exceed customer expectations, positioning themselves for success in an increasingly competitive market.